Hope smiles from the threshold of the year to come, whispering ‘it will be happier.’

― Alfred Lord Tennyson

Together, we spent much of the year enduring the many hardships that 2020 unleashed upon us: the COVID-19 global pandemic, a shutdown-induced recession, widespread unemployment, a sudden and severe 34% collapse in the S&P 500, isolation from loved ones, widespread and violent social unrest, and the most contentious election cycle in recent history. However, because we don’t do doom and gloom at DEM, we are choosing to kick off the new year by reviewing how our core beliefs allowed us to not only survive but thrive, even during a year like 2020:

Plan Wisely:

- We Spartans entered the year armed with lifetime financial plans engineered to achieve our most cherished goals, secure financial independence, and leave a meaningful legacy to those we love.

- We ignored the noise and made our decisions within the context of these plans, not in response to current events, economic conditions, or, heaven forbid, temporary market fluctuations.

- Our retirees were armed with at least two year’s worth of anticipated withdrawals safely tucked away in bear market reserves, eliminating any immediate cashflow uncertainty.

- We helped our business owners secure crucial Paycheck Protection Program (PPP) loans to keep employees on the payroll, and in turn, protect the value of our most important assets.

- We controlled what we could control by navigating the complexities of the CARES Act, suspending Required Minimum Distributions (RMDs), initiating Roth conversions, and developing charitable giving strategies to minimize our 2020 tax bills.

Discipline Is Our Name, and Equities Are Our Game:

- While many investors abandoned equities in fear during the market’s meltdown, NO Spartan – zero, zip, nada – panicked, since panic is forbidden at DEM.

- Not only did we not sell, but we collectively contributed over $25 million in net new assets to our portfolios via regular contributions and new accounts. When the economic skies darkenend, we brought a bucket, not a thimble.

- As has been the case with every other bear market in history, 2020’s decline proved to be temporary, as equities finished the year at a new all-time high. Although we never knew how or when, we constantly assured you that this too shall pass.

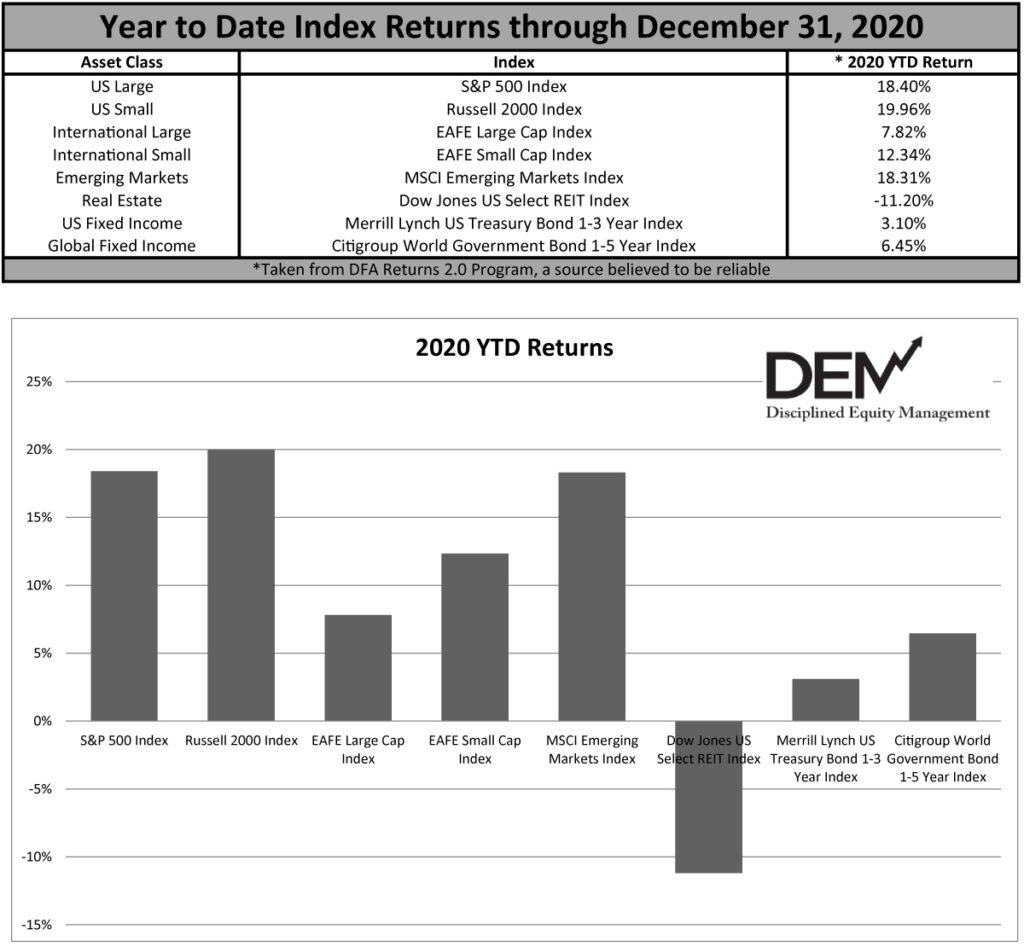

- Exactly as intended, our globally diversified portfolios of low-cost, non-correlated equity asset classes (US, International, Emerging Markets, Growth, Value, Large, and Small) behaved differently throughout the year.

- This presented us with several opportunities to trim outperformers and add to our underperformers via our disciplined rebalancing process.

- While US Large Growth stocks currently trade at multiples not seen since the tech bubble of 2000, other equity asset classes are still attractive since lower prices correlate with higher expected returns.

As goal-focused, plan-driven investors, we will continue marching confidently toward our goals in 2021, not because of our ability to predict events or markets, but because of our commitment to these core beliefs. We thank you for both the privilege and the pleasure of serving as your family’s trusted advisor. Whatever it has in store for us, our sincerest wish is that the new year’s whisper of ‘it will be happier’ will prove true for you and your loved ones.

Don Davey

Senior Portfolio Manager

Disciplined Equity Management

Plan Appropriately, Invest Intelligently, Diversify Broadly, Ignore the Noise