Our year-end newsletter provides us with an opportunity to restate the general principles that govern DEM’s philosophy of providing investment advice. Specifically:

- Planners, Not Prognosticators. Long-term investment success is derived from continuously acting within the context of a lifetime financial plan. Investment failure results from continually reacting to current events, the economy, and/or the markets. As such, DEM is goal-focused and planning-driven, sharply distinguished from market-focused and events-driven.

- Equities Are Our Game. At the end of World War II, the precursor to the S&P 500 Index stood at about 16. As we enter 2020, the index stands at 3,231. Based in part, on this exceptional historical track record, we DEM Spartans fund our most cherished lifelong goals by accumulating and holding low-cost, globally diversified, tax-efficient equity portfolios.

- Discipline Is Our Name (literally). During the aforementioned 75-year period, equities experienced no fewer than fifteen Bear Markets with an average decline of 30% in response to or anticipation of a variety of political climates, economic events, and natural disasters. However, because the only way to capture 100% of the permanent equity gains is to ride out frequent temporary declines, we make no attempt to forecast or time the markets.

- Focus On The Objective. The only benchmarks we care about are the ones that indicate whether we are on track to achieve our goals.

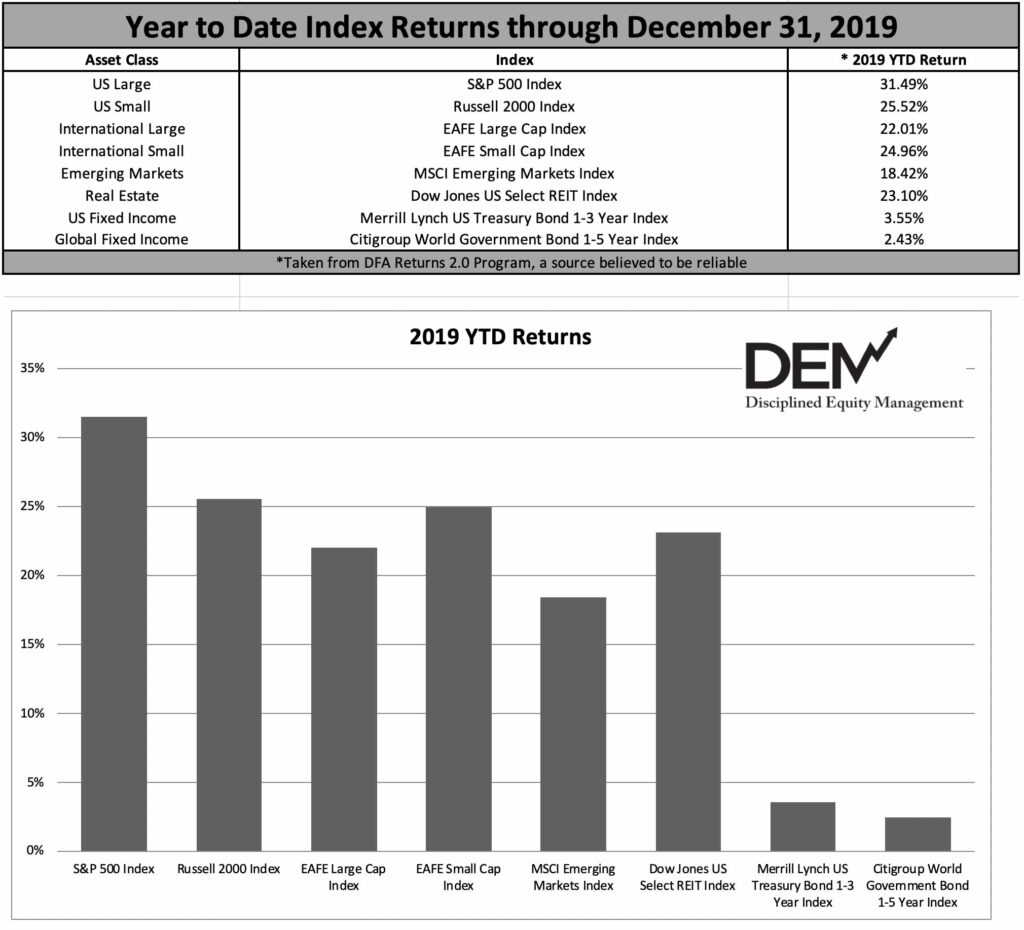

In the midst of a 20% decline in equity prices back in January 2019, I wrote: “At 2,507 on the S&P 500 and consensus 2019 earnings estimates at $174, my blissfully unscientific guess is that one of those two numbers is headed for a significant revision.” Mind you, this was merely a casual observation, not a prediction. Even though the economy slowed somewhat, manufacturing appeared to stall, and full-year earnings will likely come in a bit lower than estimates, the S&P 500 still soared more than 30% during 2019, punctuating a phenomenal decade of 16% annualized returns.

But what struck me the most about 2019 was the persistently negative tone of the financial media over the trade war with China, an earnings recession, and/or Trump’s impeachment. Apparently, droves of investors drank this pessimistic Kool-Aid, because according to Lipper’s preliminary figures, 2019 likely saw the greatest equity mutual fund/ETF redemptions on record. Imagine that. During the last year of one of the best decades ever for stocks, the overriding sentiment among investors was nothing short of full-blown panic. So rather than celebrating with us Spartans as our equity portfolios propelled us ever closer toward our goals, most investors took a giant step backward as they tried to play the market timing game. Such a pitiful shame.

As for the year ahead, it is overwhelmingly unlikely that 2020’s returns will come anywhere close to matching those of 2019. This is true, but it is also irrelevant. Here’s what is relevant: As goal-focused, planning-driven investors, we will continue to march confidently toward our goals — not because of our ability to predict returns, but because of our unwavering commitment to owning shares of the World’s Best Companies through thick and thin within the context of our well-engineered plans. For me, that is the great lesson of this genuinely great year.

Thank you, most sincerely, for being our clients. It is both our honor and our pleasure to serve you and your families.

Don Davey

Senior Portfolio Manager

Disciplined Equity Management

Plan Appropriately, Invest Intelligently, Diversify Broadly, Ignore the Noise