Before reviewing how the economy and equities fared during 2018, allow me to restate DEM’s philosophy on rendering financial advice:

- DEM is goal-focused and plan-driven, sharply opposed to market-focused and current-events-driven. If there is one thing my 20 years in the business has taught me, it is that successful investors continuously act on well-crafted Lifetime Financial Plans while failed investors react to current events and the markets.

- DEM cannot, will not, and must not make any attempt to forecast the economy, time the market, or predict which asset class/style will outperform any others. We are Planners, not Prognosticators.

- Once we engineer a Lifetime Financial Plan and fund it using our low-cost, tax-efficient, globally diversified portfolios, we remain committed to both unless/until your situation/goals change.

- We measure success not against some arbitrary benchmark, but on the mathematical probability of you achieving your lifetime goals. Better said, our primary objective is to minimize the probability of failing to achieve your goals.

With that, here are just a few of the economic metrics that blazed forward during 2018:

- Unemployment plummeted, wage growth accelerated, and worker productivity surged.

- For the first time in American history, the number of job listings exceeded the number of people seeking work.

- Household net worth hit a record $100 trillion.

- Earnings of the S&P 500 companies leaped upward by more than 20%, cash dividends set a new all-time high, and total cash returned to shareholders via dividends/buybacks since the Great Panic of 2008-2009 surpassed $7 trillion.

Meanwhile, equity prices did what they do best, bounce around:

- Last January, I wrote: The returns for the S&P 500 were positive in all 12 calendar months, the major equity indices posted gains of 15% to 35%, and the maximum peak-to-trough decline was a paltry 3% hiccup. But now it’s time to return to reality.

- As if on cue, last February brought a long overdue 10% correction, followed by a new all-time high in September, before the fourth quarter ushered in the first 20% peak-to-trough Bear Market decline since 2011.

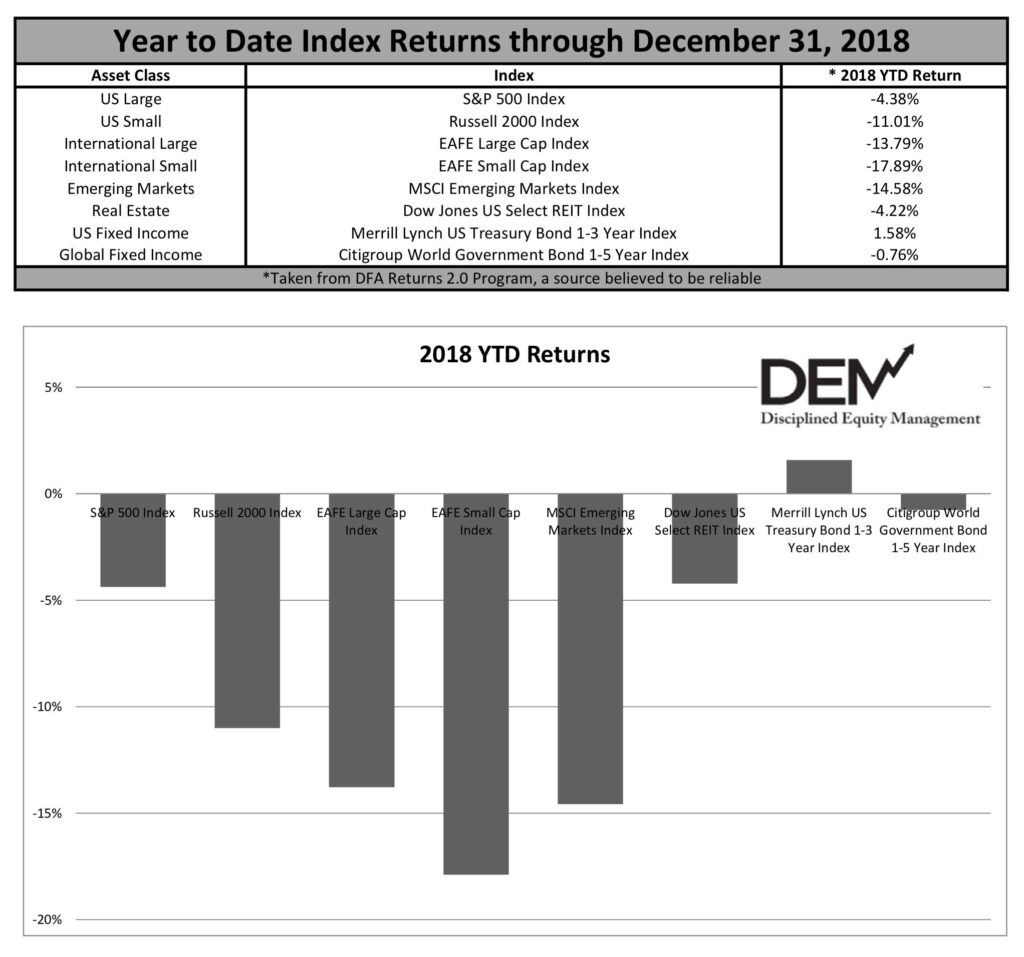

- While the U.S. Large Cap indices finished the year about 5% lower, small company, international, and emerging market equities all performed differently, reaffirming our portfolios are properly diversified.

Like each year before it, 2019 is wrought with uncertainties, chief among them trade policy, interest rates, an aging economic expansion, and the effects of a Democratic-controlled House of Representatives. Rather than fret over if/when/how any of those things will unfold, we Spartans will simply remain optimistic that somehow, someway, the Great Minds that run the world’s Great Companies will continue to unleash ways to generate profits, pay dividends, and, ultimately, accrue value.

Armed with this unwavering confidence, we accumulators (via contributions and/or dividend reinvestments) are looking forward to eagerly gobbling up shares of our most beaten down positions at temporarily depressed prices. Those in the distribution phase will tap into Bear Market Reserves for the next year (or two) to avoid converting perfectly normal temporary fluctuations into permanent losses. Meanwhile, at 2507 on the S&P 500 and consensus 2019 earnings estimates at $174, my blissfully unscientific guess is that one of those two numbers is headed for a significant revision.

Happy New Year!

Don Davey

Senior Portfolio Manager

Disciplined Equity Management

Plan Appropriately, Invest Intelligently, Diversify Broadly, Ignore the Noise