Active Investors, Passive Investors

and Engineered Portfolios

It is my sincere hope that by now, everyone reading this newsletter can recite by heart our DEM Four Pillars of Investment Success: Plan Wisely, Own Equities, Invest Intelligently, and Ignore the Noise. The first two are by far the most important. After all, any family that fails to live within their means, maximize retirement plan contributions, fully fund college savings plans, minimize tax liabilities, draft proper wills, and name the proper beneficiaries on insurance policies will undoubtedly fail to achieve their lifetime goals no matter how they invest. Once the Plan is in place, few could argue that the primary determinant of one’s lifetime wealth will boil down to the fundamental decision of whether to boldly accumulate shares of the World’s Best Companies throughout one’s lifetime or to cower behind the illusion of safety in fixed income. But after those decisions are made, how does one invest intelligently in equities? Consider the three primary schools of thought:

- Active Investors rely on research, predictions, and hunches to identify mispriced securities and/or time markets. While we would all like to believe that a portfolio of only the best securities bought at precisely the right times and managed by a brilliant Harvard graduate with a PhD in finance will consistently outpace a benchmark index, the truth is that active investing has two major drawbacks:

- It rarely works. In a white paper published last year titled The Mutual Fund Landscape, our friends at Dimensional Fund Advisors tracked the performance of 2,758 actively managed equity mutual funds from January 1, 2000, through December 31, 2015. Astonishingly, they discovered that during that period, only 17% of the original funds managed to outperform their respective benchmark indices. And lest you believe the myth that exclusive, high-priced hedge fund managers possess some magic formula that enables them to fare any better, consider the following: http://www.businessinsider.com/vanguard-shines-in-protgs-1-million-bet-with-warren-buffett-2017-2

- It is difficult to stick with. Even the few investors lucky enough to pick market-beating funds inevitably experience periods of underperformance lasting from months to years. During these times, shareholders are forced to decide whether their fund is merely experiencing a temporary setback or their fund’s manager has lost whatever golden touch he may have possessed. This dilemma typically triggers shareholder redemptions at the most inopportune times. In fact, the most recent Dalbar annual report calculates the average investor’s real-world dollar-weighted return over the past 30 years to be a dismal 3.66% versus a 10.35% time-weighted return for the S&P 500 index.

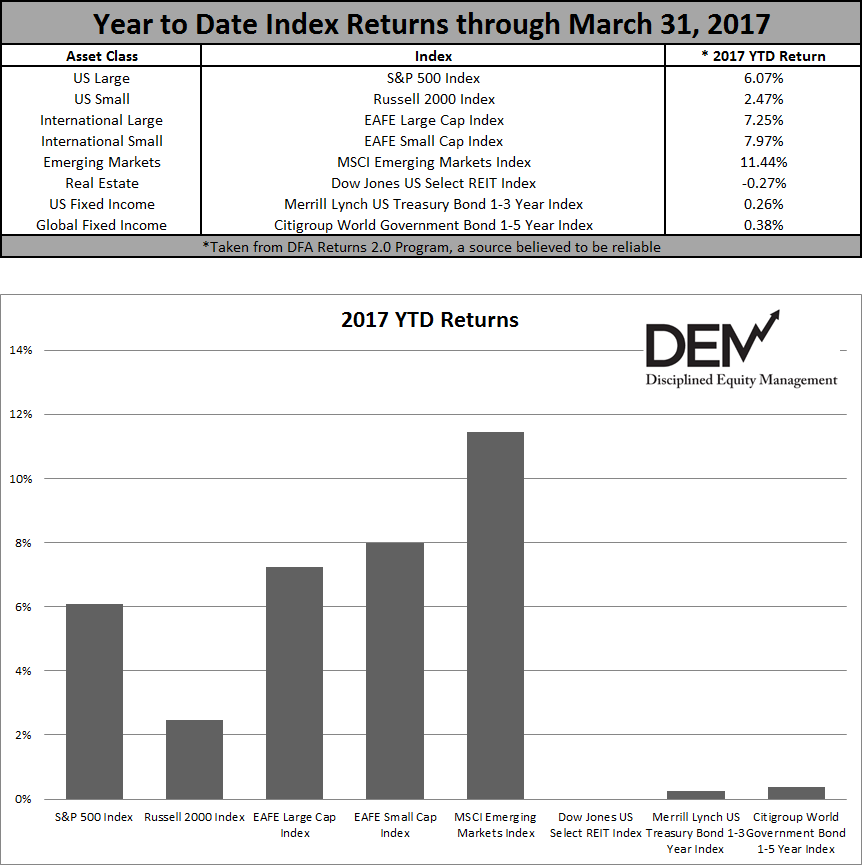

- By contrast, Passive Investors operate on the assumption that laws of supply and demand among millions of willing investors exchanging shares in the $80 trillion global equity market do a very good job of setting security prices efficiently. They believe that in an ever-connected world, all available information is immediately reflected in the prices, rendering any attempt to beat the market futile. As such, they construct portfolios using funds designed to track commercial benchmark indices (S&P 500, Russell 2000, EAFE, etc.), such as those offered by Vanguard.

- At DEM, we combine the best of active and passive investing by constructing Engineered Portfolios. We believe wholeheartedly in the efficient-market premise espoused by passive investors. But we also acknowledge the mountain of Nobel Prize–winning academic research demonstrating that portfolios tilted toward small, value, and profitable companies offer higher expected returns. Through our relationship with Dimensional Fund Advisors, we engineer low-cost, tax-managed, broadly diversified portfolios with calibrated exposure to these specific dimensions of risk. And because our portfolios always deliver precise exposure to the factors we are targeting, short-term periods of underperformance are never a concern for us.

Make no mistake: our portfolios are in no way immune to the inherent volatility of equities, nor are any of you immune to the perfectly normal emotional responses to it. But I founded DEM on the beliefs that putting a sound financial plan in place, investing primarily in equities, engineering intelligently designed portfolios, and providing unwavering discipline through thick and thin gives you the highest probability of achieving your lifetime goals…and me the satisfaction of having achieved mine.

Don Davey

Senior Portfolio Manager

Disciplined Equity Management

Plan Appropriately, Invest Intelligently, Diversify Broadly, Ignore the Noise