Father Knows Best

Twenty-five years ago this month, I was selected with the 67th pick in the NFL draft, fulfilling my childhood dream—and every Wisconsin kid’s dream—of becoming a Green Bay Packer. Within weeks, I magically morphed from a broke graduate engineering student at the University of Wisconsin into an NFL rookie with a $90,000 signing bonus check in hand ($73,458.47 after taxes; I still have the pay stub).

I immediately used a portion of my newfound wealth to make my first investment: an engagement ring for my high school sweetheart, who would become not only my life partner but also the mother of our five beautiful daughters. (My investment in her remains the best investment I’ve ever made.) But I then faced the same decision all investors face: What should I do with the rest of the money?

Many of my fellow rookies spent the bulk of their newly acquired NFL wealth on expensive houses, fancy cars, flashy jewelry, and luxurious vacations. Some bragged about investing in countless “sure thing” business opportunities, such as night clubs, restaurants, and real estate. Fortunately, neither lavish spending nor speculative investing appealed to my conservative Midwestern sensibility.

As I began my professional career, my father, a former Marine, was already 25 years into his, selling industrial abrasives for the diversified global behemoth 3M Company (NYSE: MMM). Throughout the turbulent ’70s and ’80s—Watergate, oil crises, stagflation, Reaganomics—Dad proudly maintained his confidence that, as one of the Great Companies of the World, 3M would continue to improvise, adapt, overcome, increase earnings, and pay dividends. He believed so strongly in the company that he committed a portion of each and every paycheck to the purchase of shares of 3M stock through the company’s employee stock purchase program. Paycheck after paycheck, year after year, through good times and bad, my Dad’s disciplined investment strategy gradually transformed him from an everyday employee into a wealthy shareholder of a Fortune 500 company.

Back then, I had no clue how the global political, social, technological, and economic landscapes would evolve over the next year, let alone the next 25 years. But my father’s disciplined, methodical, patient, common sense investing plan resonated with his number-crunching son. After some research, I discovered it was possible to own equity in not only 3M but 499 other Great Companies of the World by investing in a low-cost index fund.

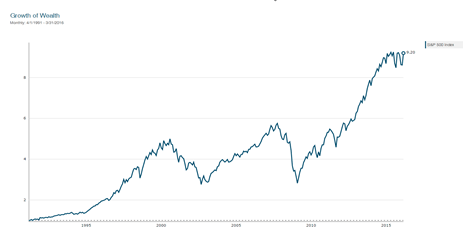

Against the advice of my teammates, my agent, and my commission-hungry A.G. Edwards broker (not coincidentally, my agent’s brother-in-law), I used the remainder of my signing bonus to purchase an S&P 500 index fund, thereby creating my first portfolio and embarking on my journey as a lifetime equity investor.

Since then, I have lived through dozens of crises, including wars in Iraq and Afghanistan, three recessions, countless natural disasters, horrific terrorist attacks, and the two worst bear markets since the Great Depression. Yet through it all, the S&P 500 has increased almost tenfold, and Nobel Prize-winning research has enumerated the benefits of incorporating tax management, global diversification, and the four-factor model into a portfolio. As a result, my portfolio has evolved beyond a simple S&P 500 index fund, but my core investment philosophy of committing to a low-cost, diversified, equity-dominated portfolio through thick and thin has not changed one bit. This approach has served me remarkably well for the past 25 years and DEM for the past 18.

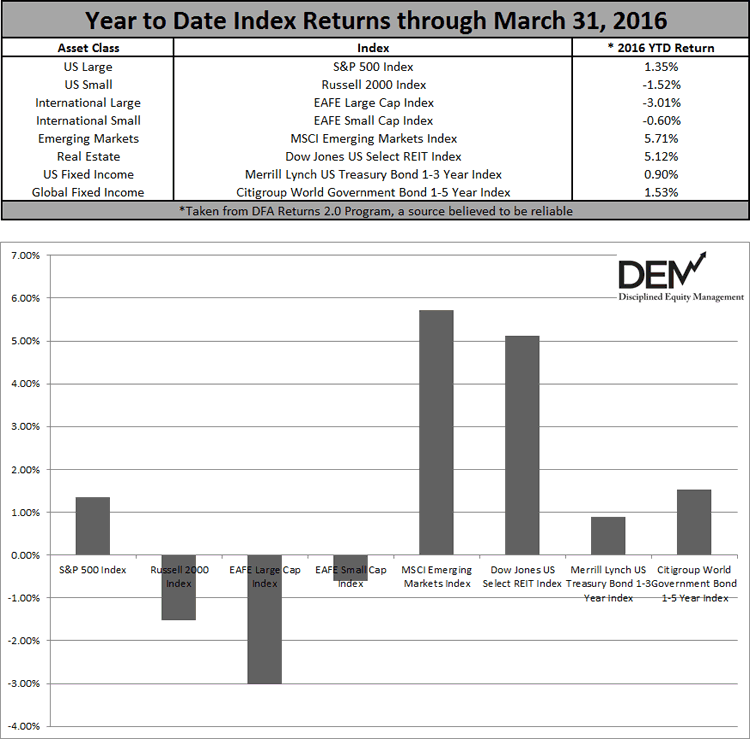

After enduring the worst start to any calendar year in history, the S&P 500 actually finished in the black for the first quarter. Just like every other decline that preceded it, this year’s China Correction now appears as just another indiscernible blip on our long-term charts. It turns out that Father Knows Best after all. Thanks, Pop!

Don Davey

Senior Portfolio Manager

Disciplined Equity Management

Plan Appropriately, Invest Intelligently, Diversify Broadly, Ignore the Noise