March 31st, 2015

When we look at the year to date performance of the major equity asset classes, we see that our best performer of 2014 (US Large) has now given way to 2014’s worst performer (International Small). Although we had no idea which asset class would lead in 2015, we are currently reaping the rewards of having increased our International Small exposure inside our globally diversified portfolios during last year’s methodical rebalancing trades. Chalk another one up for prudent diversification and a disciplined approach which forces us to always sell high and buy low.

The big news on the macro-economic front this year has been the Federal Reserve’s signaling that it will likely begin raising interest rates later in 2015 in response to a strengthening economy. This announcement triggered a mini panic in the stock market over the course of several trading days in March. Yes, you heard this right. Those entrusted to analyze the state of our nation’s economy believe that conditions are becoming increasingly favorable for companies selling goods and services. In response, speculators reacted by selling ownership in these same businesses. What is going on here?

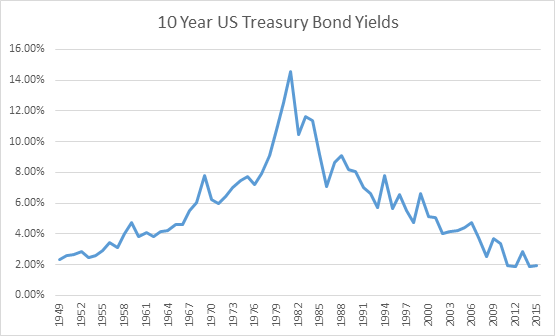

As lifetime equity investors, we waste none of our precious time trying to anticipate the short-term direction of interest rates, the economy, or the stock market. The whole concept of modifying one’s lifetime investment policy based on things unknowable seems exceptionally foolish to us. But even for those who try, the only possible explanation for selling equities based on Janet Yellen’s comments would be a belief that higher interest rates will somehow lead to lower stock prices. Rather than argue the merits of this theory as a philosopher, let’s first test this hypothesis as a scientist. Below is a chart of the 10 year US Treasury Bond Yield over the past 66 years:

As you can see, interest rates climbed steadily from 2.31% in 1949 to a peak of 14.59% in 1982, thirty-three years later. They then began an eerily symmetric thirty-three year decline from 14.59% down to today’s 1.88%. So how did the stock market perform during these two polar opposite mother of all interest rate cycles?

It turns out that the S&P 500 produced essentially identical returns during each of these two time periods, meaning the data simply do not support the “rising interest rates are bad for stocks” hypothesis.

Having debunked not only the worthwhileness of the intent, but the validity of the theory itself using empirical evidence, we can now turn our attention to more philosophical questions. Instead of interest rates, might it be that the primary determinant of equity prices over the long run is actually the earnings and dividends of the underlying companies? Might it be that the invisible hand of capitalism guides the economy and the markets? Might it be that the world’s Greatest Companies are run by the world’s smartest and most innovative people? Might it be that the equity market’s exceptional historical returns are a result of Great Companies like Coca Cola evolving from selling a single product to selling hundreds of different drinks, Apple developing a telephone more powerful than IBM’s original mainframe computer, and Wal-Mart making low prices available to a burgeoning middle class in China? Might it be that many of the things we take for granted today but did not exist ten years ago (Facebook, IPads, hydraulic fracking, three dimensional printing, etc.) represent tangible examples of the incredible power of human imagination and innovation? Might it be that hundreds of yet unimagined products, services, and industries will evolve over the next 10, 20, and 50 years, creating new sources of earnings and dividends for even more Great Companies, resulting in even higher equity prices?

And finally, doesn’t it seem likely that those of us (1) wise enough to accumulate ownership in Great Companies and (2) disciplined enough to hold them dearly through thick and thin will reap huge rewards throughout our lifetimes…regardless of interest rates?

Don Davey

Senior Portfolio Manager

Disciplined Equity Management

Plan Appropriately, Invest Intelligently, Diversify Broadly, Ignore the Noise