We Told You So

I have a confession to make. Ever since the stock market reached its lows back in March of 2009 (6,443 on the Dow and 676 on the S&P 500), I have been patiently waiting to gloat. So with all due respect to Walt Whitman, please bear with me as I unapologetically sound my barbaric YAWP over the roofs of the world: WE TOLD YOU SO!

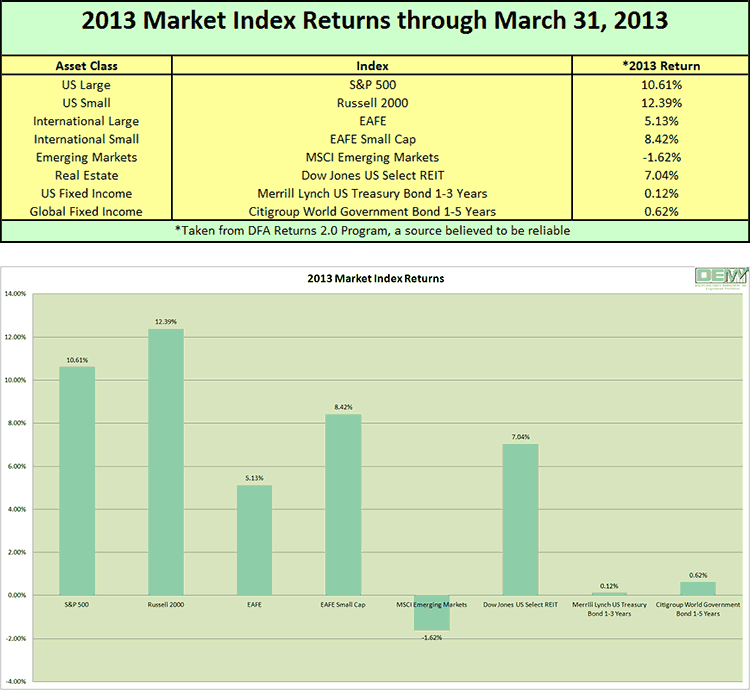

The stock market recently recovered every penny (and then some) of the temporary damage it inflicted upon investors during the Financial Crisis/Great Recession, just as we said it would. As unprecedented as it seemed at the time, it is now crystal clear that the entire experience was nothing more than a slightly longer and deeper permutation of a garden variety Bear Market, thirteen of which we’ve experienced since the end of World War II. With karmic symmetry, the market’s Recovery has been more robust than average with equities soaring more than 225% from their lows (to 14,500 on the Dow and 1,550 on the S&P 500). Tragically, after succumbing to the foolish notion that “it is different this time”, most investors have been collecting money market interest on the order of 0.05% throughout one of the greatest Bull Markets in U.S. history.

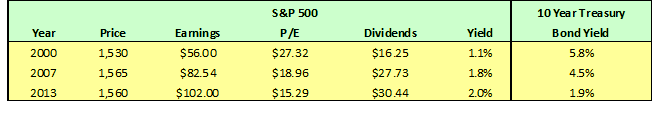

But not you. As equities tumbled, panic ruled, and the financial media bombarded you daily with their own barbaric YAWPs of Armageddon, you wisely turned to us for guidance. We listened to your fears. We empathized with you (easily done, considering our lifetime portfolios are invested exactly like yours). We admitted honestly that we had absolutely no idea how or when the crisis would end. But unlike the Doom and Gloomers, we remained optimistic. We suggested that equities might never touch these levels again during our lifetimes. We remained confident in the ability of capitalism’s “invisible hand” to re-ignite the economy as it has for the past few centuries. We reminded you that the earnings, dividends, and thus, stock prices of the Great Companies of the World had always recovered. In short, we never wavered from our conviction that, just like every other crisis that had come before it, this too would end. We told you it would be foolish to liquidate shares, thereby converting temporary fluctuations into permanent losses. Therefore we advised you to adhere to our disciplined approach. Despite all of this, many of you remained fearful and some even frustrated with our lack of a “solution” (flee to gold, hide in cash, move to bonds until things “settle down”). Despite some reservations, every single one of you trusted us enough to heed our advice. And sixteen short quarters later, we have been rewarded handsomely for doing so.

Valuations aside, we chose to take comfort in the fact (optimism is after all, a choice) that at anything close to its historical trend line growth rate, the Dow will likely eclipse 100,000 within the next twenty years. I can’t wait to YAWP WE TOLD YOU SO!

We have a few administrative issues to address this quarter:

First, we are very excited to announce that we recently opened a branch office in Atlanta with two new very talented employees. Rebecca Phillips will be serving as Portfolio Manager for our DEM Atlanta office and adds fifteen years of industry experience to our team. Her long-time colleague Debbie Boyce has also joined us as a Client Service Manager. Adding Rebecca and Debbie allows us to enhance the depth and breadth of our services as we establish a much-needed presence in Atlanta. Please forward this newsletter to your friends, family, and business associates in the Metro Atlanta area who are in need of the same quality investment advice and services that you have grown accustomed to.

We are equally excited to announce that our partners at Dimensional Fund Advisors recently launched a series of Growth Portfolios which offer us exposure to a newly identified dimension of equity returns. We now have even more tools at our disposal to customize a portfolio designed specifically to achieve your individual goals. As always, we will notify you immediately of any changes we make to any of your accounts.

We will be celebrating our fifteenth year of professional money management in June. Many of you have been with us since our inception in 1998 and have seen our disciplined approach guide you through the Boom of the 1990s, the Asian Contagion, the Tech Bubble/Burst, September 11th, three Wars, two Recessions, and five different Presidential terms. In an industry where advisors change course daily, we are proud that our fundamental tenets and approach have remained unchanged since day one. Words cannot express how much we appreciate the confidence you have placed in us to handle your family’s financial affairs.

Finally, enclosed are hard copies of our updated SEC Disclosure Document (ADV Part 2) and Privacy Policy. The only material change for 2013 was our addition of the Atlanta branch office. If you would like an electronic copy of either or both, please contact us.

Onward!

Don Davey

Senior Portfolio Manager

Disciplined Equity Management

Plan Wisely, Invest Intelligently, Diversify Broadly, Ignore the Noise