December 31st, 2010

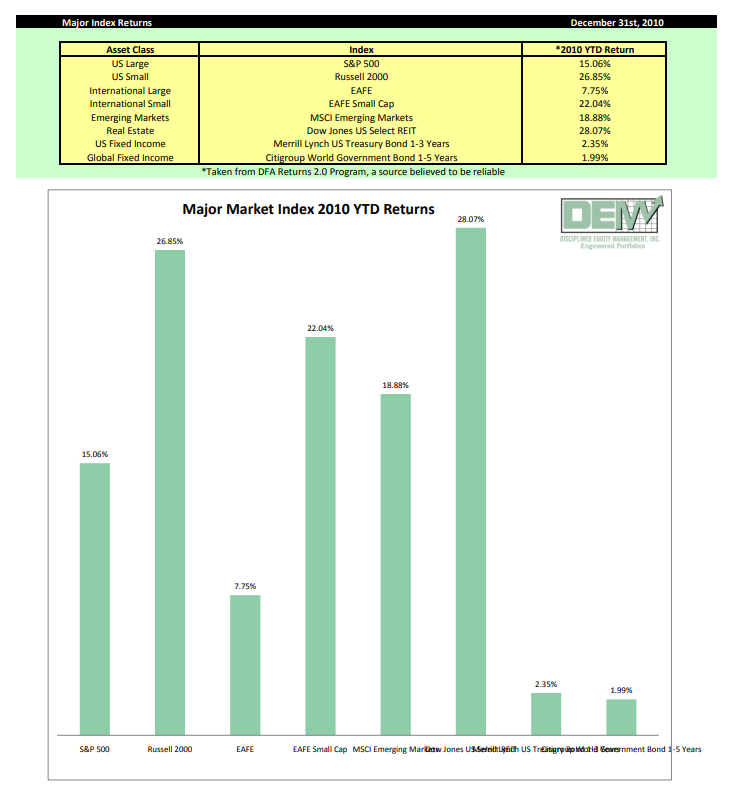

The more things change, the more things stay the same. As with each New Year before it, 2010 gave birth to its own unique economic, political, and environmental crises: a rapid deterioration in the housing market, a sweeping overhaul of the US healthcare system, a European sovereign debt crisis, an unprecedented 1000 point Flash Crash, an oil spill that enveloped much of the Gulf of Mexico, sweeping political change in Congress, and record high gold prices, just to name a few. Despite this, the US broad equity market indices closed the year by surpassing levels not seen since before Lehman Brothers collapsed in September of 2008. And once again, low-cost, globally diversified equity portfolios performed substantially better.

In the spirit of the New Year, let us all renew our Resolution to abide by the DEM Ten Commandments of Investing once again in 2011:

- I acknowledge that the long term Real Return (net of taxes and inflation) on bonds has historically been very close to zero.

- I acknowledge that with Capitalism comes a long term positive expected Real Return on capital that is there for the taking via the equity markets.

- I will embrace, rather than fear, equities’ volatility because it is the very source of their higher expected returns.

- I accept that the future is, by definition, uncertain, rendering forecasts and market timing completely useless.

- I will take the time to develop a Financial Plan consistent with my goals and maintain the discipline to invest new capital into my Plan through thick and thin.

- I will modify my Plan in response to changing life circumstances, not in response to market movements.

- I will adhere to an investment philosophy discovered, tested, and implemented by the very founders of modern portfolio theory.

- I will diversify my portfolio broadly across multiple securities, asset classes, countries, and investment styles because diversification remains the closest thing I will ever find to a free lunch.

- I will rebalance my portfolio by systematically by trimming that which has recently outperformed to buy more of that which has recently underperformed.

- I will ignore the minute to minute noise inherent in the financial media because although there will always be something to worry about, it is never really “different this time.”

Bring on 2011!

Don Davey, Senior Portfolio Manager

Disciplined Equity Management