June 30th, 2010

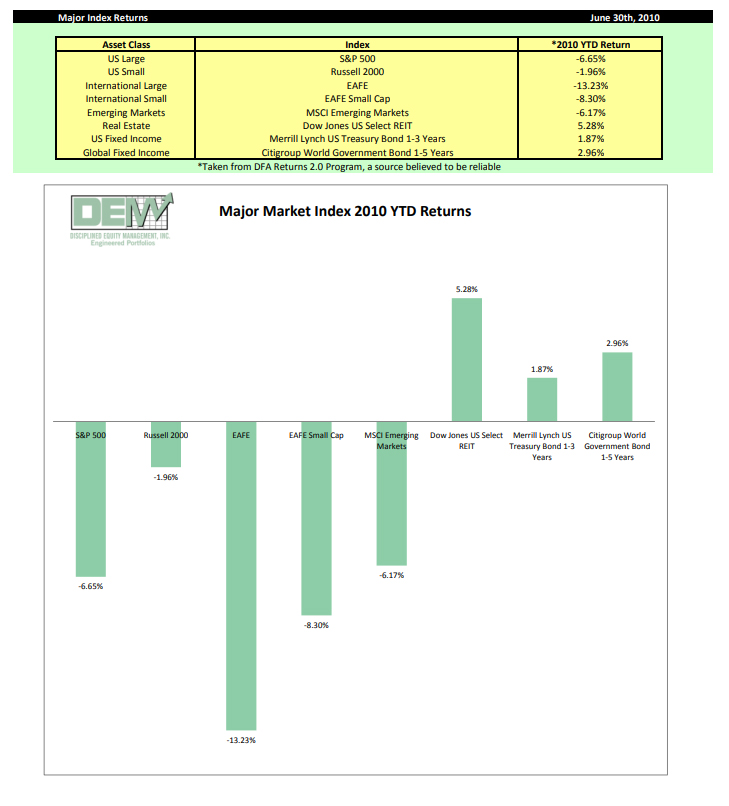

After posting healthy gains during the first quarter of 2010, a dismal second quarter was enough to drive the year to date return for the S&P 500 into the red. In keeping with the non-correlated nature of our various asset classes, small cap stocks fared significantly better while international stocks fared worse. Despite all speculation to the contrary, diversification is still very much alive and well.

Of course true investors only measure returns over the course of decades, not ninety day intervals. And now that we are 5% into the new decade, let us focus for a minute on our ultimate Destination. Although we have multiple short term client-specific goals, our overriding objective is to achieve and maintain our clients’ independence and dignity throughout their lifetimes. This requires two equally important conditions:

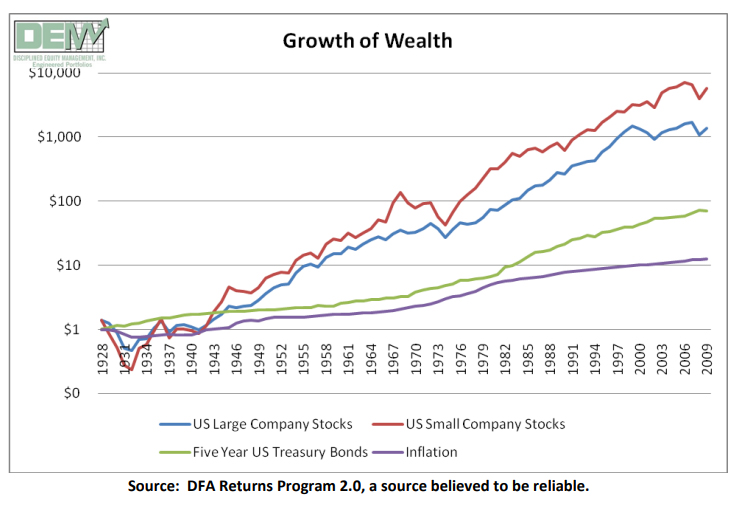

Financial Independence means having the ability to do what you want, when you want to do it. For some, this will mean travelling around the world. For others, this will mean continuing to work at an enjoyable job absent the pressure of needing the paycheck. Still others will decide to devote their time and energy to philanthropy. Regardless of the form it takes, financial independence can only occur once we have accumulated a portfolio approximately equal to twenty-five times your projected annual expenditures. After accounting for taxes and inflation, methodically accumulating shares in a portfolio of the world’s greatest companies during our working years is the only way most of us will ever amass a nest egg significant enough to make Financial Independence a reality during the course of an average working career (Figure 1).

Financial Dignity means that once achieved, our Financial Independence will not be a temporary condition, but a permanent one. It is an undeniable truth that the cost of all of the goods and services we must purchase during our lifetimes (food, housing, health care, etc.) tends to rise. Therefore, it is obvious that our incomes must continue to rise at least proportionately. Unfortunately, relying on fixed income

instruments (cash, CDs, bonds, or annuities) to generate income dooms us to a very undignified, ever decreasing standard of living. By contrast, our clients’ Financial Independence is a permanent and dignified condition because of our reliance on a rising dividend income stream from equities (Figure 2).

Roughly one hundred client families have climbed aboard our DEM Ark and entrusted us to navigate them on their voyage to Dignified Financial Independence. Our steadfast Ark is forged from our low cost, globally diversified, equity dominated portfolios. We will provide the knowledge, experience, and discipline required to guide you through even the most treacherous of seas. The storms will come and go, but we will arrive safely at our Destination. All you need to do is to stay on board.

Invest Intelligently. Diversify Broadly. Ignore the Noise.

Don Davey

Senior Portfolio Manager

Disciplined Equity Management