March 31st, 2010

Déjà vu all over again?

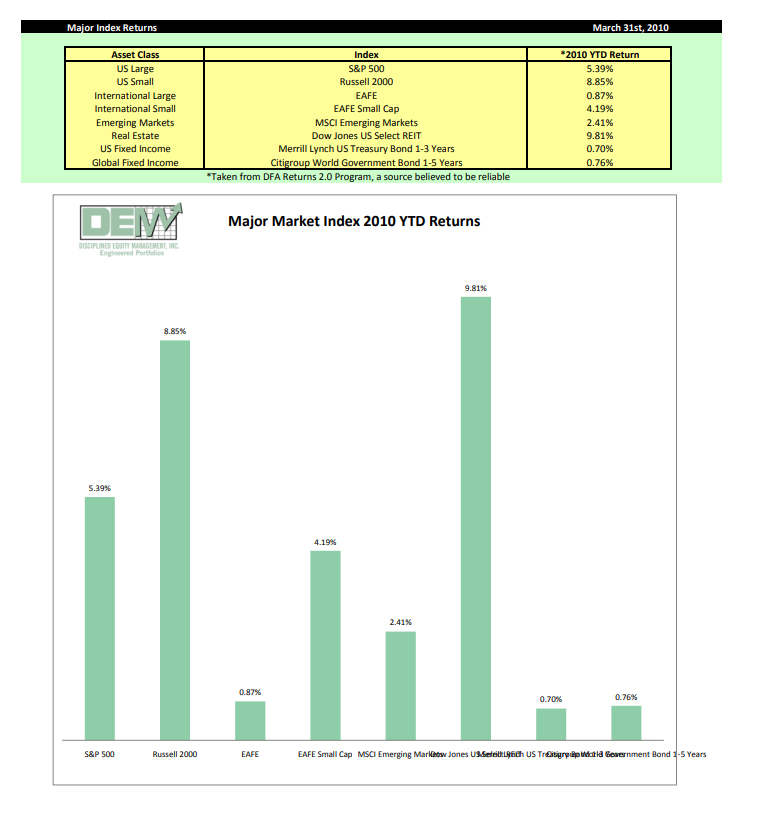

After the market turmoil of 2008 and 2009, the first quarter of 2010 was graciously uneventful by comparison. The S&P 500 gained a little more than 5% during the first three months of the year, making this the best start to a calendar year since 1998. Taking a broader perspective, the market is now up over 60% from its lows reached during the first quarter of 2009. In hindsight, our unwavering advice to maintain our disciplined approach throughout the Global Financial Crisis has proven once again to have been very wise counsel.

Despite this astounding run, avid viewers of financial newspapers, websites, and television shows would hardly notice any difference between now and last year. While the Dow Jones Industrial Average was hitting its multi-year low of 6,700 in March of 2009, investors were being bombarded with stories about the depth of the global financial crisis, failing financial institutions, Bernie Madoff’s Ponzi scheme, the prospects of the Dow sinking to 3,000, and the implicit certainty of a pending Great Depression II.

In hindsight, with the Dow now flirting with 11,000, these doomsday scenarios seem almost comical. Yet these very same media outlets are currently churning out a brand new set of doomsday scenarios relating to Greece’s financial crisis, record high unemployment rates, continued softness in the real estate market, unsustainable budget deficits, and the prospects for higher future interest rates and inflation.

In one of his most famous Letters to Shareholders, Warren Buffett once wrote that successful investing requires only two things: (1) a sound investment strategy and (2) the discipline to adhere to it through thick and thin. Of these, it is the discipline that investors struggle with the most, in large part because we are constantly bombarded with news about of the latest and greatest crisis de jour.

Intelligent investors understand and accept that no matter how good or how bad things are, there will always be something to worry about. Rather than allow ourselves to be paralyzed by fear of the unknown, we simply accept economic and market cycles as a necessary ingredient in the “invisible hand” of capitalism. Because the future is, by definition, unknowable, we steadfastly refuse to pay attention to, much less participate in speculation. Fortunately, the ability to predict the future is hardly a prerequisite for successful investing. In fact, those who aligned their investments with the dire predictions of a year ago have paid a very steep price for their foolishness.

Invest Intelligently. Diversify Broadly. Ignore the Noise.

Don Davey