The Not-So Lost Decade

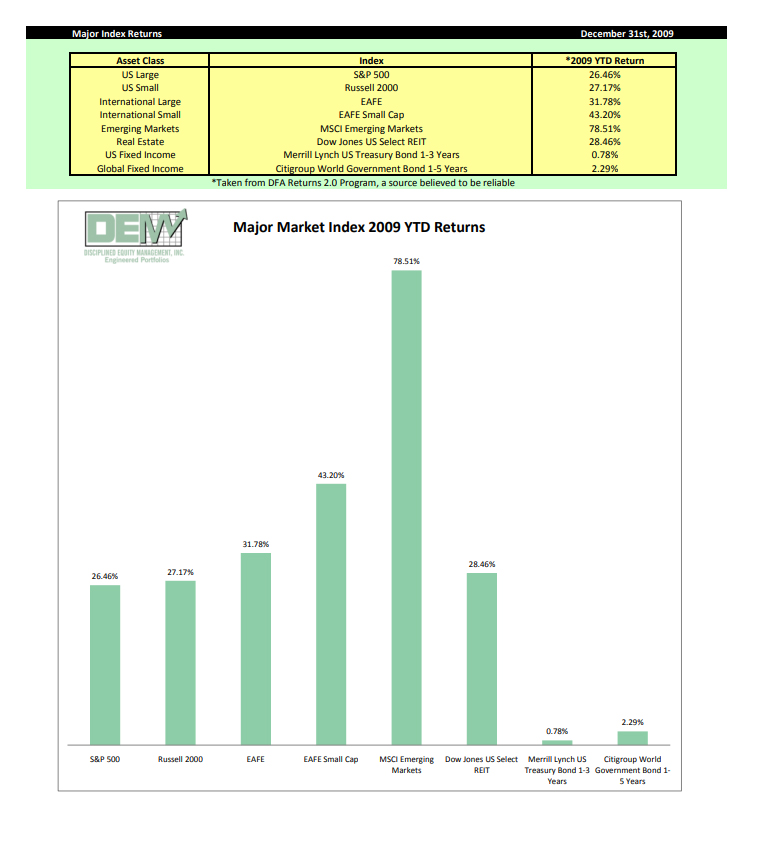

Calendar year 2009 will go down in the record books as one of the best years ever for stocks. The major equity market indexes posted gains ranging from an impressive 26% for US Large all the way up to an astonishing 78% for Emerging Markets. By contrast, short term US Treasury bonds produced exactly one one-hundredth of that return at 0.78%. After underperforming bonds in 2008, stocks resumed their winning ways with a vengeance in 2009.

December 31st, 2009 also brought an end to one of the most eventful decades in history. During this time period, we experienced the Dot.com boom and subsequent bust; September 11th; not one, but two global recessions; not one, but two Wars in Iraq and Afghanistan; not one, but the two worst Bear Markets since the Great Depression; the Global Financial Crisis; etc. Although each of these events had an impact on the stock market, it is important to remember that none of them were knowable in advance.

Much is currently being written about this so-called “Lost Decade” for stocks because it resulted in a negative ten year annualized return for the S&P 500. Although this is true, the popular financial media are currently spewing three myths which we need to dispel:

Myth #1: Investors were fools for having committed their savings to equities during the past decade.

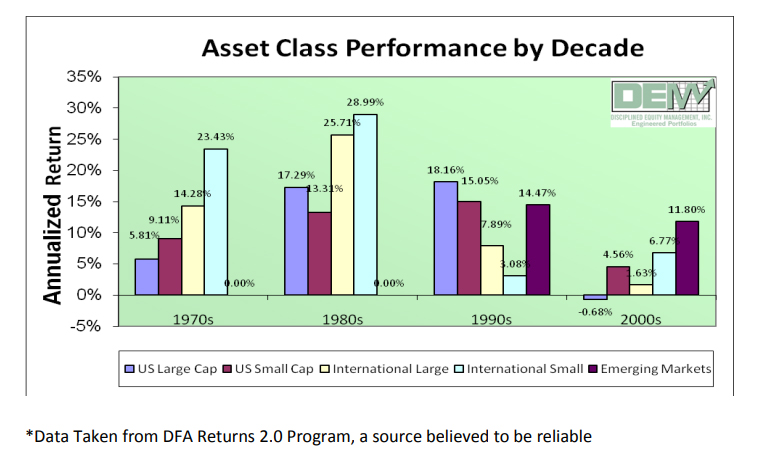

Reality #1: Below appears the ten year annualized returns for US Large, US Small, International Large, International Small, and Emerging Markets stocks during each of the past four decades*:

It is true that those who gambled by owning only US Large stocks experienced disappointing returns during the 2000s. However the returns for US Small, International Large, International Small, and Emerging Markets stocks were all decidedly positive. In fact, a diversified portfolio including all of these asset classes would have produced a very respectable, inflation beating return in each of the past four decades, including the 2000s.

This is exactly why our DEM portfolios include all of these asset classes. We never make predictions about future events and/or their affect on the market. We never make bets on which types of stocks will perform the best in any given period. Instead, we build globally diversified multi-asset class portfolios using our low-cost institutional DFA funds. This ensures that we always capture virtually 100% of the global equity market returns.

Myth #2: Because stocks have posted disappointing recent returns, investors must now accept a New Normal that will result in below average equity returns.

Reality #2: Although the future is unknowable, history suggests exactly the opposite is true. We analyzed the fifteen worst performing decades for the S&P 500 going back to 1926. The ensuing decades produced a positive return every single time. In fact, during the twenty years following the Great Depression Era 1930s, stocks produced an annualized return roughly one and a half times higher than average throughout the 1940s and 1950s. Instead of leading to lower returns, decades of sub-par returns have historically given birth to decades with higher than average returns.

Myth #3: Bonds are “safe”.

Reality #3: Even if we put nearly a century worth of evidence aside, our strongest argument for owning stocks as we head into the 2010s is the relative yield of their chief alternative, bonds. Short term US Treasury Bonds are currently yielding 1.6%, virtually guaranteeing a negative real return for investors net of taxes and inflation. We find it quite disingenuous that the financial media have chosen to all but ignore the real risk involved for investors in these “conservative” investments.

As we enter the new decade, we remain more committed than ever to our low-cost, globally diversified, and disciplined investment approach. We are incredibly proud of the investment solution we provide for our clients. But we are most proud of the deep, trusted advisor relationship we have built with every single one of you. Our sole mission remains to provide a successful lifetime investment experience for each of our families through constant education, superior investment solutions, and our unwavering discipline. Bring on the 2010s.

Don Davey

Senior Portfolio Manager

Disciplined Equity Management