September 30th, 2009

One year ago this month Lehman Brothers collapsed, Merrill Lynch vanished as an independent entity, and AIG was taken over by the US Government. These unprecedented events rocked the very core of the global financial system, resulting in a precipitous decline in the global equity markets. The worsening news about the floundering economy, Bernie Madoff’s Ponzi scheme, and the collapse of the real estate market intensified throughout the fourth quarter of 2008. By March of this year, talk of Great Depression II dominated the national media.

Understandably, we fielded many telephone calls and emails from concerned clients over the past year. Despite the pervading gloom and doom, our unwavering advice has been to either (1) stay the course or (2) maximize this opportunity of a lifetime by accumulating more shares at depressed prices:

Q3 2008 DEM Newsletter

As painful as this period has been, the markets may very well get worse before they get better. For those of you who are able, we will make every attempt to increase your contributions to your account to take full advantage of this opportunity. If this is not practical for your situation, we will continue to rigidly adhere to the disciplined approach which has served us so well. Invest Intelligently. Diversify Broadly. Ignore the Noise.

Q4 2008 DEM Newsletter

Those of you heeding our recommendation to purchase additional shares are currently doing so at prices we may never again see in our lifetimes. Yes, the economy remains fragile heading into 2009. And yes, the financial crisis is far from over. But as Warren Buffet said as he was investing his entire personal fortune into equities during this quarter, if we wait for the robins to arrive, spring will be over. Fortune favors the bold.

Q1 2009 DEM Newsletter

Our behavior as investors, particularly during market declines, has a much greater influence on our lifetime wealth accumulation than our underlying investment performance. Those of us committed to our fundamentally sound, low cost, and disciplined investment approach will not only survive the current market environment but go on to thrive during the inevitable recovery.

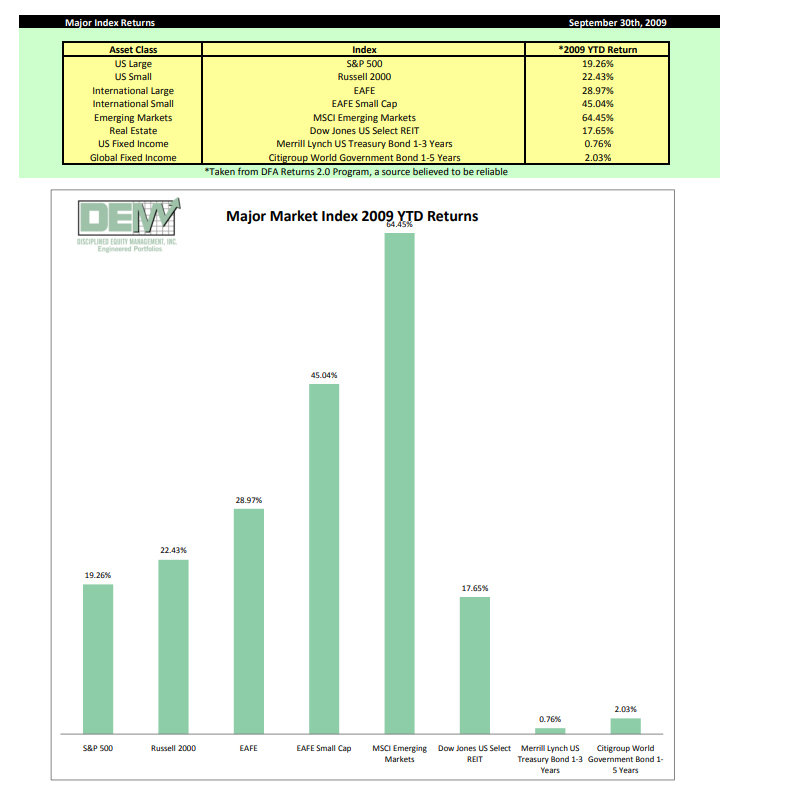

With the global equity markets posting robust year to date gains of 20% – 60%, the wisdom of our guidance is obvious in hindsight. We openly admit that we had no idea how this unprecedented crisis would end. But we did know with absolute certainty that it would end. As intelligent investors, that is the only thing that matters.

Consider us the captains of your financial ship. Trust us to navigate through even the most treacherous of waters to arrive safely at our destination. Our elegant, low-cost, globally diversified investment solution will capture the superior lifetime returns offered by capitalism. Our job is to keep you safely on board and on course to ensure we all receive the capital returns we are entitled to.

Don Davey

Senior Portfolio Manager