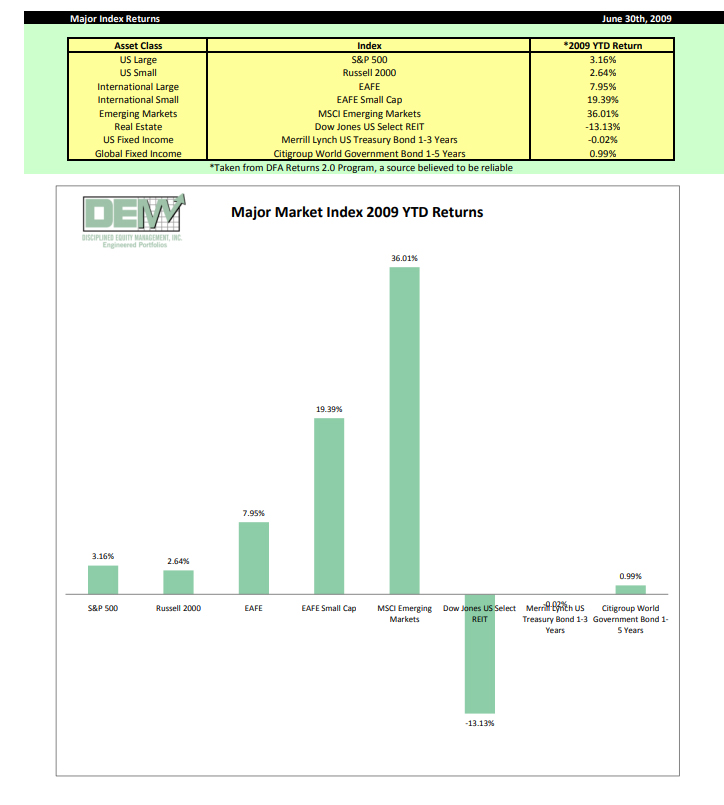

June 30th, 2009

Global Equity Markets continued to rebound violently from recent lows during the second quarter of 2009. International markets enjoyed the most pronounced surges, catapulting the year to date returns for both International Small and Emerging Markets stocks well into the double digits.

Rather than cheering the recovery in his portfolio, one client recently expressed concern about the recent upswing in the equity markets. He posed the question: “Don’t these violent swings simply demonstrate the Riskiness of owning stocks as opposed to bonds in the first place? And if so, why should I take such a Risk?”

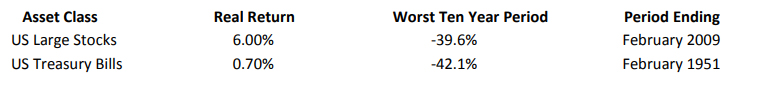

This question speaks to the very core of our Investment Philosophy because the most fundamental decision every investor must make is whether to allocate his capital to equity investments or to fixed income investments. Rather than speculate, let us consider the following Real Return (after-inflation) data compiled from the CRSP Database for the Period from January 1926 through March 2009:

Note that for simplicity sake, we have ignored the significant tax advantages stocks offer real world investors over bonds. Yet even when comparing only the head to head pre-tax Real Returns, the conclusions are obvious:

- The Real Return from stocks has been almost ten times the Real Return from bonds.

- The worst ten year period for stocks has been milder than the worst ten year period for bonds.

Presented solely with this data, virtually every investor would chose to invest in stocks over bonds. Unfortunately, the inherent short term volatility associated with stocks tends to cloud the judgment of even intelligent investors.

Interestingly, much like today, the US economy in February 1941 presented bond investors with a dangerous combination of historically low interest rates and fertile ground for the seeds of inflation. As the US economy roared to life in the aftermath of that generation’s Crisis (World War II), interest rates steadily climbed and inflation ensued. While equity investors enjoyed the fruits of yet another powerful US economic recovery, this nasty combination decimated bond investors in a ten year Bond Bear Market worse than anything equity investors have experienced.

Therefore our client’s question cannot be answered without first accurately defining Risk. It is true that equity investors expose themselves to Investment Risk due to the volatile nature of stock market returns. However, they have historically been well-compensated for this Risk with a long term return of six percentage points above and beyond the nominal inflation rate. Bond investors may be able to avoid some Investment Risk because of the lower inherent volatility of fixed income investments. However, in doing so, they incur additional Purchasing Power Risk for which they have not historically been compensated.

Our tenets remain unchanged: Commit to Equities. Diversify Broadly. Invest Intelligently. Ignore the Noise.

Don Davey

Senior Portfolio Manager