March 31st, 2009

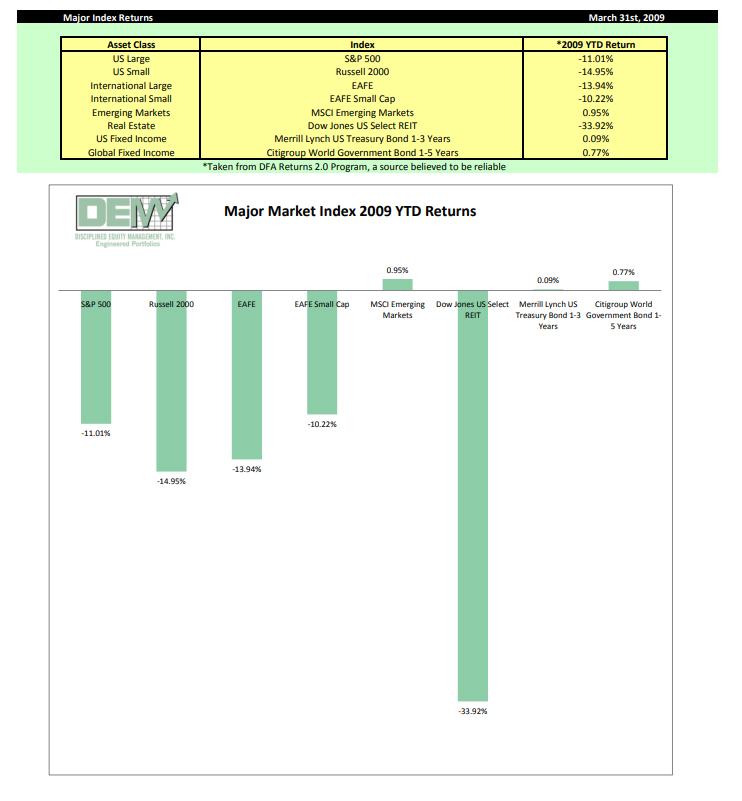

Even after recording one of the best gains on record in March, most of the major equity indexes posted declines during the first quarter of 2009. Interestingly, the lone exception was the volatile Emerging Markets asset class which actually finished the quarter with a modest gain.

Stepping back a bit, we see that from its peak on October 9th, 2007 to its most recent trough on March 5th, 2009, the Dow Jones Industrial Average declined by 53.44%. This puts the current Bear Market among the worst in US history. Challenging market environments such as these make us appreciate the many advantages of our affiliation with the Nobel Prize winning economists at Dimensional Fund Advisors (DFA). Allow me to highlight just three of them:

(1) Foundations in Academic Research

DFA affiliated advisors such as DEM have access to all of the latest academic research and theory. We urge all of you to take advantage of this by following this link to review this six part presentation from Wesley Wellington http://www.dfaus.com/share/whatshou/. This online webinar provides excellent insight into our overall investment approach, the current market environment, and precisely what we as investors need to be doing right now. Although institutions pay handsomely for access to this type of information, we are able to share it with our

clients for free.

(2) Rock Bottom Fees

Costs matter when it comes to investing. While retail mutual funds typically charge 1.50% annually in expenses, our institutional DFA funds typically charge less than a third of that. This means the declines in our portfolio values are due almost entirely to capital market losses. Unfortunately, many other investors have suffered market losses plus an additional 1% from higher expenses.

(3) Exclusive Access to Institutional Funds

Retail mutual funds tend to suffer the worst during market declines as ill-advised shareholders panic and sell their shares. As these redemption requests pour in, fund managers are forced to sell stocks at depressed prices, compounding the funds’ losses. By contrast, only investors working through approved DFA Advisors have access to Dimensional’s funds. Rather than selling shares, our long-term approach to money management allows us to treat Bear Markets as phenomenal opportunities to accumulate wealth. In fact, the most recent data show that while the rest of the mutual fund industry has suffered net outflows of $30 billion – $300 billion during the past four quarters, billions of new dollars have flowed into DFA’s funds. These positive net inflows benefit all of us as DFA’s fund managers use this cash to purchase additional shares of stock at discounted prices.

Our behavior as investors, particularly during market declines, has a much greater influence on our lifetime wealth accumulation than our underlying investment performance. Those of us committed to our fundamentally sound, low cost, and disciplined investment approach will not only survive the current market environment but go on to thrive during the inevitable recovery.

Don Davey

Senior Portfolio Manager