March 31st, 2008

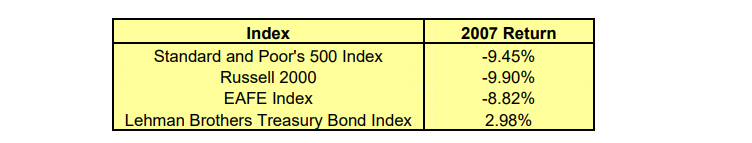

Ouch. The expanding credit crisis, worsening housing market, and political uncertainty inherent in an election year have combined to leave little doubt that the US economy is currently experiencing its first economic recession since 2001. As a result, equity investors have had no place to hide thus far in 2008. Large, small, growth, value, domestic, international, and emerging markets stocks all suffered nearly double digit losses during the first quarter. In a market like this, the fact that our globally diversified DEM portfolios held up modestly better than the indexes provides little consolation to any of us.

In light of the challenging quarter, we decided to perform one of our “Thought Experiments” to challenge the wisdom of adhering to our diversified approach through thick and thin. After all, with all of our knowledge, expertise, and experience, shouldn’t DEM have been able to both (1) anticipate the stock market slide and (2) identify an investment that would have held up even in difficult markets? Armed with the benefit of hindsight, we went to work searching our databases for the most promising opportunities as of January 1st, 2008.

After enough research, we did indeed discover an investment with surefire prospects. This company went public in 1985 and delivered outstanding growth in both earnings and dividends over the subsequent two decades. As a result, the stock produced an annualized return of over 24% per year from 1986-1999, easily outpacing the S&P 500 index. But best of all, it managed to thrive through the 2000–2002 recession and accompanying bear market. While the S&P 500 lost over 37% during that three year stretch, this stock somehow managed to gain over 44%. When the broad market recovered, this company posted consecutive record setting years in 2003, 2004, 2005, and 2006. For the twenty year period from 1986-2006, its performance had not only trounced the S&P 500 index, but even outperformed Warren Buffet’s Berkshire Hathaway stock by almost 5 percentage points per year! Had we anticipated the ugly first quarter stock market, who could have faulted us for investing some, or perhaps even all, of our client’s nest eggs into such an outstanding Blue Chip company?

Our presumed forecasting ability, extensive research, and due diligence would have led us to confidently purchase shares of a company called Bear Stearns at approximately $90 per share in January 2008. Unfortunately, unbeknownst even to insiders, failures in the subprime markets had decimated this once mighty financial giant’s underlying business. When reality surfaced, the stock price plummeted unmercifully in a matter of days. Assisted by the Federal Reserve, JPMorgan would make an offer to purchase the remnants of the company at the fire sale price of $2 per share. Think of all of the long-time Bear Stearns employees/shareholders who eschewed our diversification advice but made a fortune from their single stock portfolios. Twenty plus years of growth evaporated for every single one of them overnight. The stock market has taught us all yet another very expensive lesson about the perils of market timing and under diversification.

Fortunately for you, our only goal is to achieve and subsequently maintain long-term financial independence for you and your families. As such, we steadfastly refuse to take undue risks with your hard earned wealth. Instead, we diversify our portfolios broadly and completely ignore short-term market fluctuations. Yes, this means we will occasionally endure quarters like the one just ended. But unlike the unfortunate Bear Stearns shareholders, the down periods in our portfolios are temporary.

Don Davey

Senior Portfolio Manager

Disciplined Equity Management