October 1st, 2007

One of our most frequently asked questions is: “How will my portfolio change as I make the transition from the saving (accumulation) phase of my life to the retired (distribution) stage?”

DEM’s approach to retirement investing is markedly different from that of most money management firms. We utilize what we call our Personal Endowment approach. Much like an educational or charitable endowment, we design our retirement portfolios to produce an ever-increasing income stream that cannot be out-lived. As with everything we do, the approach was developed in the context of real world long-term historical data. The following three tenets govern the approach:

(1) Establish a sustainable withdrawal rate.

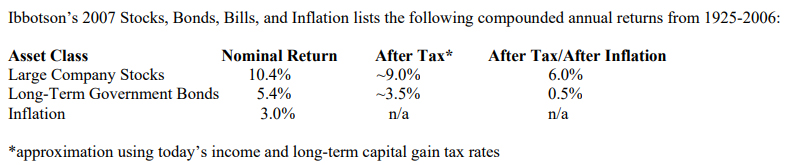

Given this, it should take little persuasion to convince you that, even for a 100% equity portfolio, our retirement withdrawal rate must be something less than 6%. We consider 4% – 5% a reasonable range. Under these assumptions, every $1,000,000 of retirement assets can be expected to generate $40,000 – $50,000 in annual retirement income.

(2) Set aside adequate Bear Market reserves.

Bear Markets rear their ugly heads without warning. And liquidating stocks at depressed prices to fund retirement withdrawals can devastate even a well-diversified portfolio. To mitigate this risk, we set aside two year’s worth of withdrawals (8% – 10% of the portfolio value) in cash and/or CDs. When (not if) the next Bear Market hits, we fund withdrawals by tapping into these reserves while we patiently wait for the market to recover.

(3) Invest the balance of the portfolio into an equity-dominated, diversified portfolio.

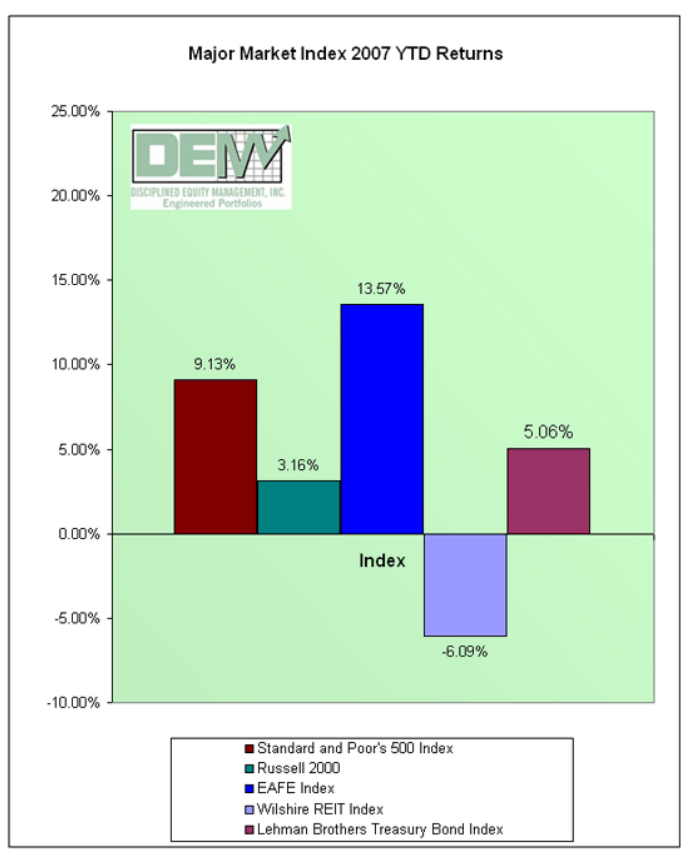

Even our retirement portfolios are tilted heavily toward stocks. One does not need to hold a PhD in mathematics to calculate that any allocation below approximately 70% stocks and 30% bonds is not likely to generate the 4% – 5% after-tax, after-inflation return we are seeking. In addition, we diversify our portfolios amongst large/small, growth/value and US/International equities to maximize our exposure to multiple, non-correlated asset classes.

A portfolio constructed using these principles should not only fund a multi-decade retirement, but also continue to appreciate. In stark contrast to the the “Die Broke” philosophy espoused by other firms, we fully expect our retired clients to bequeath substantial estates to their heirs and/or favorite charitable organizations. Best of all, because of its perpetual nature, our approach is equally suited for a 28 year old retired NFL football player as it is for an 80 year old retired entrepreneur.

Our Personal Endowment approach to retirement may be most striking for what it does not include: namely, heavy doses of preferred stocks, annuities, bonds, lifecycle funds, and guaranteed insurance contracts. These products are often marketed to retirees as “safe, conservative investments.” Although they may have specific applications, relying heavily on these to sustain an inflation-adjusted retirement is likely to disappoint.

Don Davey Senior

Portfolio Manager

Disciplined Equity Management, Inc.