June 30th, 2007

With the broad markets rallying in the second quarter to eclipse the highs set back in March of 2000, we see it fitting to re-visit a fundamental tenet of stock market investing: Bear Markets. Why re-visit such a painful topic during a period of record setting performance? Because experience has shown us that investors tend to have notoriously short memories. Fueled by the misconceptions spread by the financial press, investors tend to extrapolate recent history. When times have been recently good, they tend to project even more good times in the future. When times have been recently bad, they tend to project even worse doom and gloom. Intelligent investors do the opposite. We must recognize that good times can be interrupted at any time.

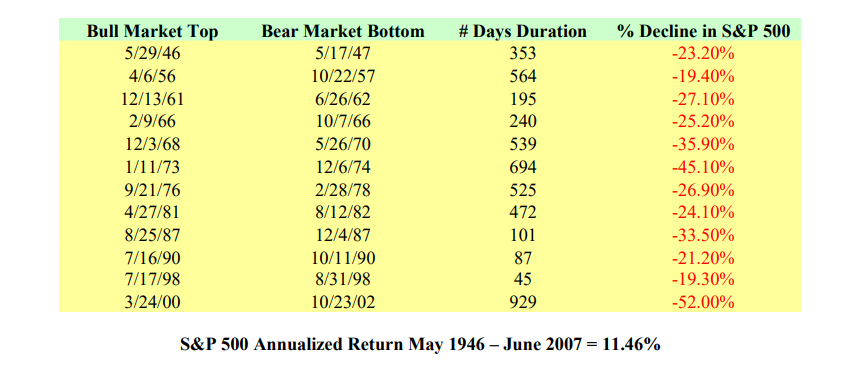

More importantly, we must also recognize that bad times never continue indefinitely. Bear markets are loosely defined as a 20% drop in the broad market averages from peak to trough. Although they are a death sentence for short term speculators, for long term investors, they offer a phenomenal opportunity for wealth creation. To illustrate, consider the chart below detailing the last twelve Bear Markets in the S&P 500 since the end of World War II, provided courtesy of Nick Murray’s excellent book “The New Financial Advisor”:

We can describe these twelve bear markets using four key terms:

- Regular Over the past sixty years, bear markets have occurred approximately once every five years. • Painful On average, bear markets have reduced a $1,000,000 stock portfolio to $700,000 over the course of a little more than a year.

- Healthy Short term speculators tend to sell shares during bear markets in fear of incurring even greater losses. Long term investors like us are happy to purchase their shares from them at substantially discounted prices.

- Temporary Without exception, the US Stock market has recovered from every single bear market in its history and gone on to reach higher highs.

As intelligent investors, this last term “temporary” is the only thing that matters to us. No matter how ugly they may get, bear markets never erase any investor’s wealth. The only way to turn the temporary fluctuations of a bear market into permanent realized losses is for an investor to sell shares. If we never allow you to lose your faith in the resiliency of the stock market, you will never sell your shares during a bear market. And if you never sell your shares at depressed prices, you will never, ever lose money in a bear market. Rest assured, you will be handsomely rewarded for this discipline: Every one million dollars invested at the bull market top of 1946 is worth over seven hundred and sixty million dollars today.

We are the first to admit that we have no idea when the next bear market will occur. However, when it does, we will continue to confidently adhere to the disciplined investment approach which has served us so well.

Don Davey

Senior Portfolio Manager

Disciplined Equity Management, Inc.