March 31st, 2007

Bonds outperformed stocks during the first quarter of 2007. While the S&P 500 managed to eek out a gain of 0.64%, the Lehman Brothers Treasury Bond Index posted an even more impressive gain of 1.51%. This gives us cause to ponder a fundamental question: Why do we prefer to invest in stocks instead of bonds?

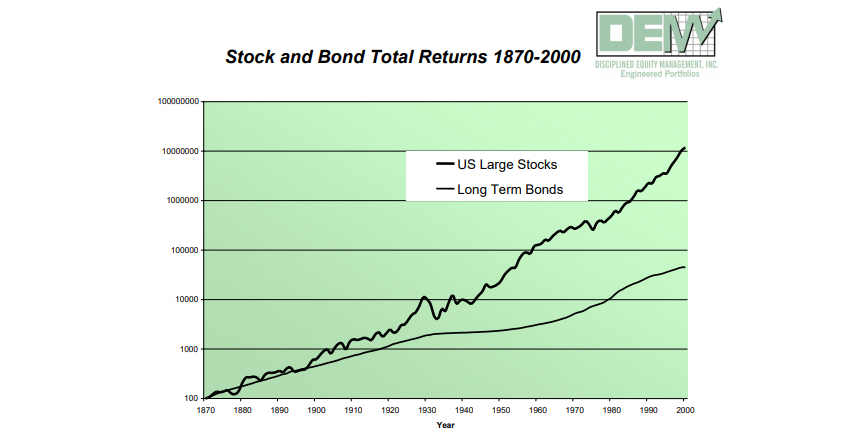

As usual, we will look back much further into history for guidance. The chart below plots the returns of US Large Company stocks versus US Long Term Bonds for the 130 year period from 1870 – 2000:

This long-term perspective reveals two things:

- Over long periods of time, stocks have outperformed bonds. In fact, when we crunch the numbers, we find that stocks have returned approximately 11% per year while bonds have managed to return roughly half of that at 5.5%.

- Stocks are inherently more volatile than bonds. The many zigs and zags we see in the long term chart reveal the many bull and bear markets that equity investors have experienced. Bond investors, on the other hand, have experienced a much smoother ride.

The difference in the long-term expected return from stocks versus bonds is known as the equity risk premium. Investors expect to earn a premium for assuming the risk of owning equities as opposed to bonds. Put another way, the very reason stocks offer higher returns than bonds is because they are more volatile than bonds. Capital markets are drawn to a state of equilibrium which balances risk and return. Suppose at any instant that bonds offered a long-term expected return of 11% per year while offering lower volatility (i.e. less risk) than stocks. In such an upside-down world, investors would liquidate their stock holdings and pour this cash money into the bond market. The mass rush of sell orders for stocks would drive down stock prices. The corresponding rush of buy orders for bonds would drive up bond prices. After all, what investor would not prefer a higher return for less risk?

The market would quickly stabilize at the point where (1) bond prices had risen sufficiently to push their yield back below the return of stocks and (2) stock prices had fallen enough to push their expected return back above the yield of bonds. When viewed in this light, we realize that the way things are is the only way things could possibly be.

Patient, disciplined, and diversified stock investors take much comfort in these facts. We confidently ignore day to day, month to month, and year to year fluctuations in the markets. Armed with a wealth of history and logic, we keep our eyes focused firmly on our long-term goals.

Don Davey

Senior Portfolio Manager

Disciplined Equity Management, Inc.