March 31st, 2006

Our portfolios continued their strong performance during the first quarter of 2006. As we analyze our portfolio component returns, we cannot help but notice the recent out-performance of US Small and International Stocks over US Large Stocks.

This has led some of our clients to pose the question: “Ought we not stray from our disciplined allocations and increase our exposure to US Small and/or International Stocks, in an effort to capture these higher returns?”

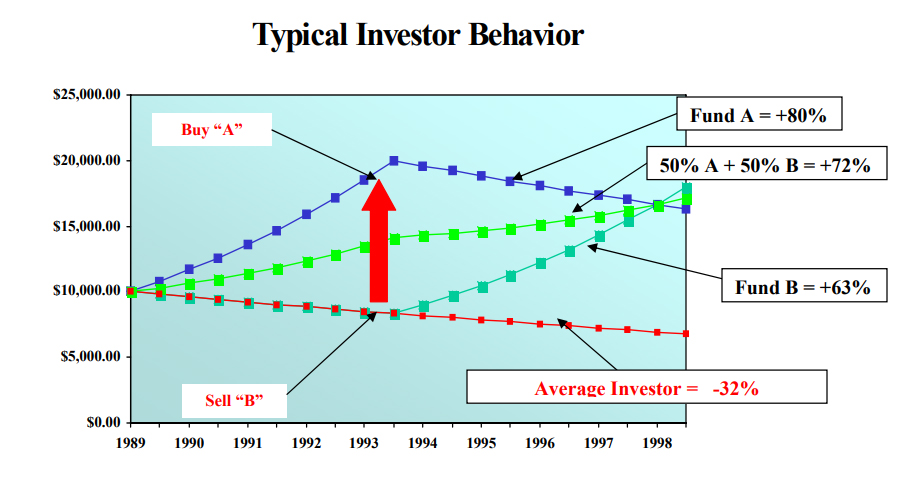

The answer is an emphatic no. To illustrate why, consider the two fictional investments depicted in Figure 2 below: Fund A and Fund B. Despite the short-term volatility, each fund produced a handsome return over a ten-year time horizon. An investor who bought Fund A and maintained discipline would have earned an 80% return over the ten year stretch. An investor who bought Fund B and maintained discipline would have earned a 63% return. An investor who divided his money equally between Fund A and Fund B and maintained discipline would have earned a 72% return. Although the end results were slightly different, any of these scenarios would have produced an acceptable return for the investor.

But consider what often happens to average (undisciplined) investors. By looking backwards at recent returns in 1993, they conclude that Fund A is somehow superior to Fund B. It seems logical to them to sell some or all of their “under-performing” Fund B shares and reinvest the proceeds into “out-performing” Fund A in an effort to capture these higher returns. However, as happens with all investments from time to time, note that Fund A soon goes on to begin its own multi-year period of poor performance. At the end of ten years, undisciplined investors would end up owning Fund A during its worst stretch of performance, and then trade it for Fund B only to own it during its worse stretch of performance. Their resulting ten year return would be a completely unacceptable loss of 32%. It is not their lack of knowledge, but their lack of a discipline that dooms these investors to fail.

Given the four outcomes described above, we prefer the diversified portfolio containing roughly equal amounts of both Fund A and Fund B. Consequently, we intentionally construct our DEM portfolios using multiple non-correlated investment styles (Large vs Small, Growth vs Value, US vs International, etc). We have no preference for any one of these investment styles over another. We never fret over their inevitable short-term fluctuations in performance. We know that diversification will provide our portfolios with both higher expected returns and lower expected volatility over the long run. It is much more important it is to own investments that are expected to perform differently than it is to try to predict which investments are expected to perform the best.

We rigidly adhere to our disciplined approach because we are committed to delivering you and your family a successful lifetime investment experience. We are proud to have done that for so many of you over the years.

Don Davey

Senior Portfolio Manager

Disciplined Equity Management, Inc.