December 31st, 2003

“2002 has come and gone, leaving equity investors with their third consecutive calendar year of negative returns. Which begs the question: do stocks still make sense for the long-term investor? Historical perspective reveals that the answer remains a resounding yes. Remember that the primary tent of stock market investing is that the stock market is completely unpredictable over short periods of time. All of the world’s most successful investors (Warren Buffet, Peter Lynch, Sir John Templeton, etc.) freely admit as much. But they also freely admit that over long periods of time, stocks have always delivered consistent positive returns. However, the only way to capture those returns is to remain committed to equities through thick and thin.”

–excerpt from Sheard & Davey newsletter December 31st, 2002

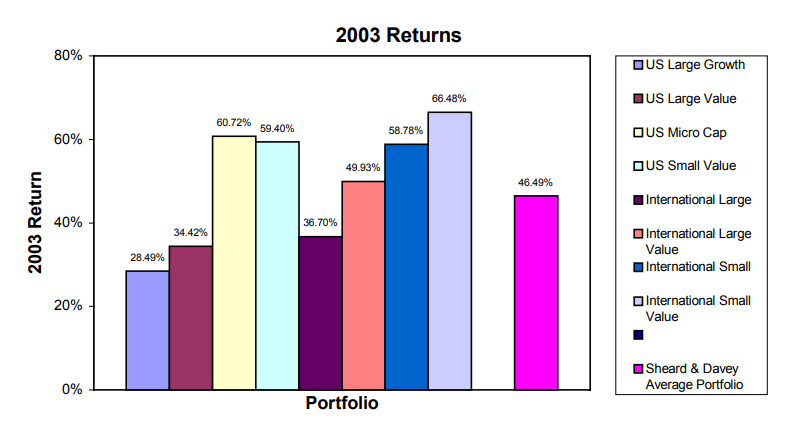

Our words from twelve months sound prophetic today. After posting consecutive losses in 2000, 2001, and 2002, the equity markets rebounded with a vengeance in 2003. More importantly, from our perspective, is that every one of our portfolio strategies outpaced the broad market averages by a wide margin. In fact, our average portfolio gained over 45% in 2003.

US Blue Chip Stocks, while posting impressive gains, were actually our worst performers on the year. This continues a three-year trend of small company stocks outperforming large company stocks and– despite much global turmoil–international stocks outperforming domestic stocks. Because it is impossible to predict which investment styles will lead the market going forward, we will continue to own all of them.

As proud as we are of what did happen in our portfolios last year, we are even more proud of what did not happen. Late trading, market timing, and other trading scandals rocked the mutual fund industry in 2003. As investors fled these funds, fund managers were forced to sell shares to meet redemptions. Ironically, those hurt the most in these scandals were the shareholders who maintained a disciplined investment approach, but had the misfortune of investing in retail mutual funds.

Dimensional Fund Advisors has long maintained a series of controls to prevent these practices from occurring in our portfolios. As such, our funds continued to experience regular positive inflows throughout the year from institutional investors and qualified individual investors like us. This is just one illustration of how our money is invested on a completely different playing field than virtually all other investors. We cannot understate how fortunate we are to have access to these institutional quality portfolios.

As always, the future is uncertain. But as we head into 2004, we must once again repeat our fundamental tenets of intelligent investing:

- Ignore the short-term noise. Through all the ups and downs, stocks will produce something on the order of 10% per year annually over our investment lifetimes.

- Invest with Discipline. Quantitatively assembled portfolios based on decades of academic research have the highest probability of exceeding that 10% return.

- Diversify. Portfolios containing large and small, growth and value, and domestic and international securities produce higher expected returns with lower volatility than concentrated portfolios.

Finally, a word about the status of our firm. As you know, in addition to managing portfolios directly for friends and family, we now also serve as the behind the scenes money manager for the clients of other investment advisors, estate planners, and accounting firms. To more accurately project our disciplined investing approach, we are changing our name to Disciplined Equity Management. Thanks to our client Jeff Novak and his incredible team at Intra-Focus.com, we are launching our new interactive website (www.DEMgt.com) for both existing and prospective clients. We know you will enjoy it.

As we enter our seventh calendar year of professional money management, we are proud to announce that we have eclipsed sixty million dollars in assets under management. We cannot possibly thank you enough for the kind referrals that you have sent us over the years to make this possible. We know that our business is built on trusted relationships with a select number of high net-worth families just like yours. We continue to look to expand our circle of clients to include your friends, family members, and business associates. We would like nothing better than to have more clients exactly like those we already serve.

Don Davey

Jeff Kopp