October 5, 2003

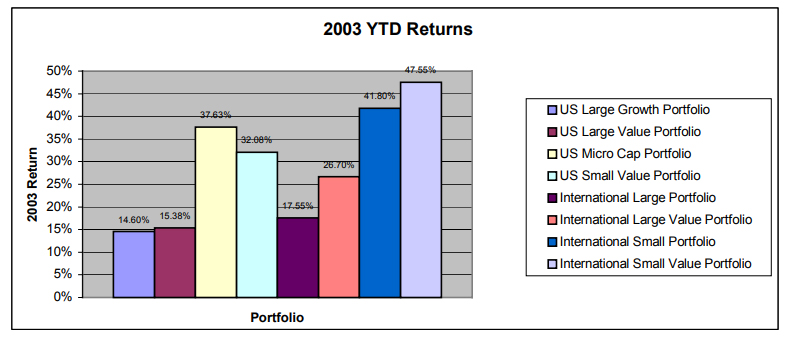

Below is a summary of our portfolio components for the first nine months of 2003:

As has been the case since October of 2002, our US and International small company portfolios have continued to lead the way out of the recent bear market, and by a wide margin. Although we have never (nor ever will) trumpet the short-term performance of our portfolios, it is important to note that the “inevitable stock market recovery” which we have been promising you for the past two years appears to be well underway. Our globally diversified portfolios guarantee our full participation in this recovery, regardless of which sectors or styles lead the way.

In the big picture, of course, the short-term movements of the market are of no importance to us. By studying history, we know that of stocks, bonds, and cash, only stocks have provided a positive rate of return net of taxes and inflation. Therefore, stocks are the only logical choice for investors looking to achieve and/or maintain real wealth. We also know that every bear market in the history of the world has ended someway, somehow. The end result of every political, economic, and global disaster has always been a market that manages to recover and go on to higher highs. In addition, academic research clearly demonstrates that broadly diversified portfolios composed of large and small, growth and value, US and international stocks tend to not only hold up better during down markets but also rocket higher during recovery periods.

Given this, we are always amazed at the amount of time and effort that investors, economists, money managers, and advisors all spend trying to justify the notion that every new calamity is somehow “different this time”. The recent recession, September 11th, corporate scandals, and the Iraq War combined to provide plenty of fuel for the doomsayers to say that the market would never recover. It is said that those who refuse to study history are doomed to repeat it. Those of us willing to study history will profit handsomely from our knowledge.

Don Davey

Jeff Kopp