Stocks

What is a stock?

In addition to issuing bonds, companies may also issue stock in their corporation to raise capital (money). These shares of stock represent pieces of direct ownership in the underlying company. As an owner, these stock certificates entitle the owner to share in the profits of the company. Unlike with their bonds, companies that issue stock make no promises about the future rate of return that stockholders will receive.

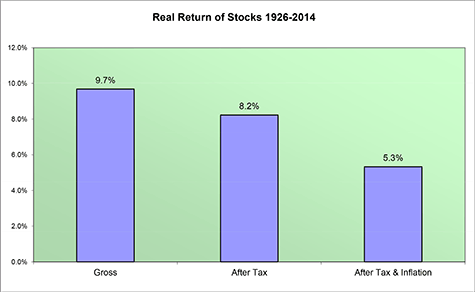

From 1926-2015 US Large Company Stocks have produced an 9.7% gross return while US Small Company Stocks have returned approximately 12.3%*. As you can see, historically, stock investors (owners) have been rewarded approximately twice as much as bond investors. Better still, gains achieved through owning stocks (capital gains) are taxed at a much more favorable tax rate (currently 15%) than bonds. So even after the effects of taxes and inflations, stock investors have been rewarded with a real return of 5-6% above and beyond taxes and inflation.

If the goal is to achieve growth in a portfolio, an investor has no choice but to commit to stocks.

*Source: Ibboton's Stocks, Bonds, Bills, & Inflation