Bonds

What is a bond?

A bond is simply an IOU for a loan. Governments, municipalities, and corporations issue bonds to raise money for various projects. These institutions accept cash from investors and, in exchange, they promise to repay the initial loan amount plus some pre-determined interest that remains fixed for the life of the bond.

Are bonds "safe" investments?

Investors traditionally think of bonds as "safe" investments and stocks as "risky" investments. However, the longer the maturity of a bond, the more time that inflation has to erode the value of those fixed payments. In addition, as interest rates rise, other investors are less willing to purchase bonds with lower interest rates. Consequently, the principal value of bonds (and bond mutual funds) tends to go down as interest rates rise. Furthermore, investors who own individual bonds run the risk that the issuing agent may default on the bond.

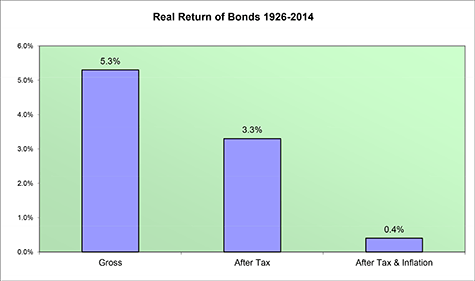

From 1926-2015 US Treasury Bonds produced a gross return of 5.3%. Unfortunately, bond interest is taxed at ordinary income tax rates, currently as high as 35%. So a 5.3% bond may only net a taxable investor 3.3% after taxes. If inflation runs at 3.0%, the real return of that bond falls to 0%. Historically, the real after-tax and after-inflation return from bonds has been very close to 0%.

Do bonds belong in a portfolio?

As we have seen, bonds have not historically provided real growth in a portfolio. However, in some instances, allocating some money to bonds may serve an important emotional purpose. The purpose of holding bonds in a portfolio is to dampen the volatility of more volatile asset classes (like stocks).

*Source: Ibboton's Stocks, Bonds, Bills, & Inflation