Bear Markets

Stock market investing is often associated with big losses in a bear market. Bear markets are certainly a part of investing. However, a look into history reveals some very interesting facts.

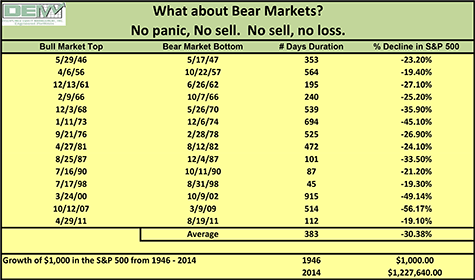

Below are the percentage losses from peak to trough for all of the bear markets that have occurred since the end of World War 11:

In fact, bear markets occur with quite a bit of regularity. They are a normal, healthy part of investing in the stock market. But how have investors fared through all of these huge temporary declines?

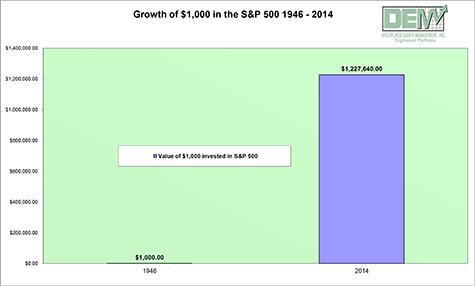

Every $1,000 invested in the S&P 500 in 1946 is now worth over $1,227,640. One thousand two hundred and twenty seven times the original investment! Through all of the "catastrophes" the United States has faced over the past 60 years, our stock market has continued to march along at about an 11% per year pace. Think about this the next time you find yourself worried about the impending war, recession, interest rate spike, depression, election, etc. Ignore the noise.