Disciplined Investing

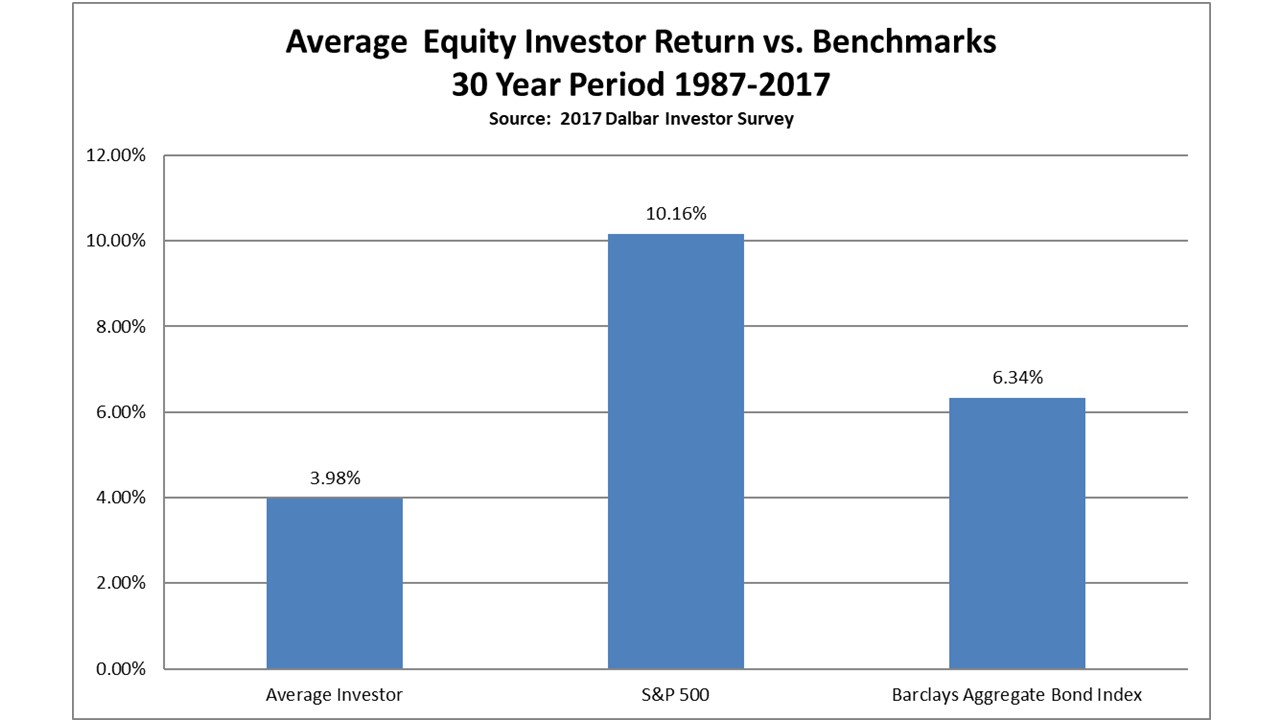

Despite the unambiguous upward trend of the stock market over the past few centuries, most real-world investors continue to achieve abysmal lifetime investment returns. The most recent data from an annual Dalbar study show that over the past thirty years, the average equity investor underperformed not only the S&P 500 Index, but the Barclays Aggregate Bond Index as well! In dollar terms, underperforming the broad market by over 6% per annum over thirty years would result in a $5.7MM reduction in wealth for every $1MM invested.

Although likely extremely intelligent, the average investor has no Plan, jumps in and out of the stock market in response to or in anticipation of crises, and constantly chases the "best performing" investments. This poor soul is doomed to fail before he even begins because he fails to realize that the primary determinant of his lifetime return has virtually nothing to do with his chosen investments' performance and virtually everything to do with his own investor behavior.

By contrast, DEM's knowledge, experience, and disciplined approach help investors avoid these pitfalls by keeping them focused on their long term goals.