Plan Wisely. Diversify Broadly. Invest Intelligently. Ignore the Noise.

It is a genuine pleasure to report to you on the progress of our portfolios—and even more important, of our financial plans—during the first six months of 2024. As I usually do in these reports before proceeding to my current observations, I’d like to reiterate a handful of what I believe are timeless truths about enduringly successful wealth management.

General Principles:

- We are goal-focused, plan-driven, long-term equity investors. Our portfolios are derived from and driven by your most cherished lifetime financial goals, not from any view of the economy or the markets.

- We do not believe the economy can be consistently forecast nor the markets consistently timed, so there is no advantage to be gained by moving in and out of the markets, regardless of current conditions.

- We believe the only method of capturing the full premium compound return of equities is by remaining fully invested at all times.

- We are thus prepared to ride out the equity market’s frequent, often significant, but historically always temporary declines. We believe that even during such trying episodes, our reinvested dividends will be buying even more lower-priced shares, continuing the power of equity compounding to our long-term benefit.

Current Observations:

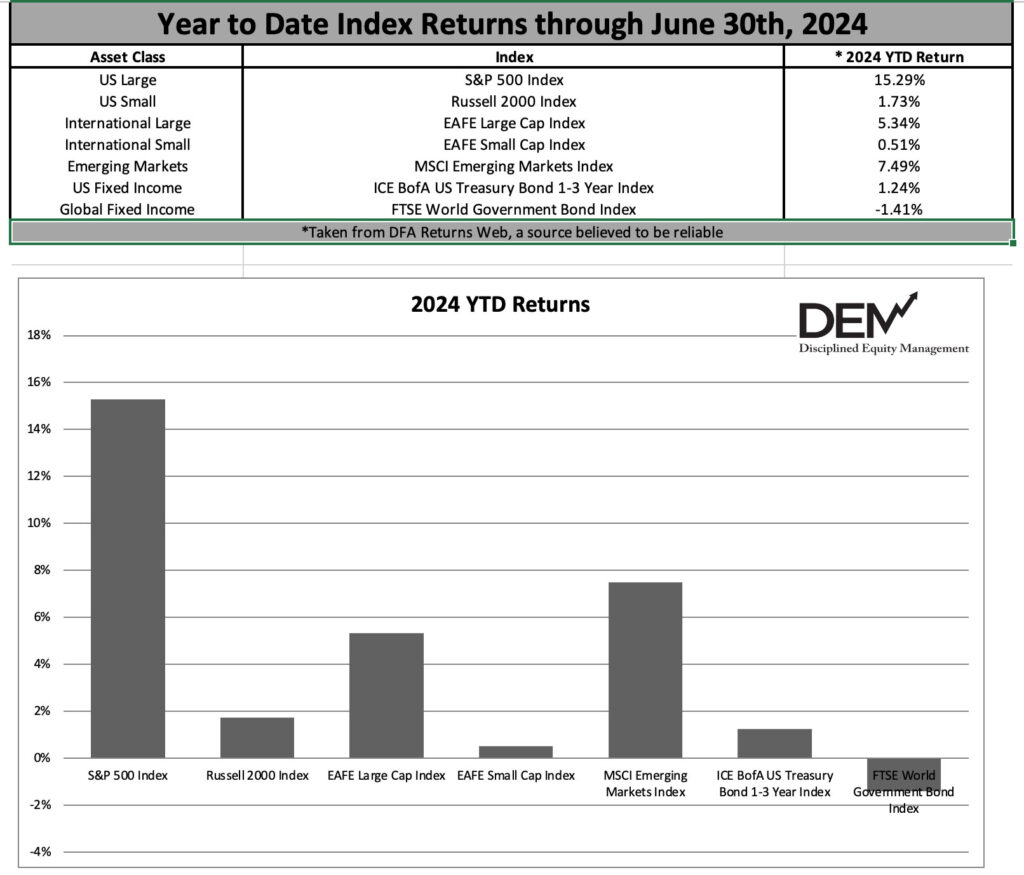

- The first six months of 2024 can be simply and accurately summed up in two observations. (1) The U.S. economy continued to grow, however modestly and (2) The equity market—responding to accelerating earnings growth and dividend increases—did very well indeed.

- Economic growth remained marginally positive, continuing to avoid recession, while job growth continued to be relatively strong. Inflation slowed very grudgingly, not providing the Federal Reserve with any urgent prompting to reduce interest rates.

- Even without stimulating rate cuts, all three major stock indexes reached significantly new high ground. Strengthening earnings and rising dividends have been the impetus for this, which is just what they fundamentally ought to be. Bloomberg’s current estimates are for S&P 500 earnings to be up approximately 8.8% this year, to be followed by a further 13.6% increase in 2025.

- Even though cash dividend payments to shareholders are at record high levels, S&P 500 companies are still paying out a below-average percentage of earnings (about 37% versus the last 30 years’ average of nearly 46%). Between that and sharply increasing earnings, there would appear to be substantial room for further dividend growth this year and the next.

- Earnings and dividends are the variables that ultimately drive the long-term value of our core investment asset: ownership equity in a broadly diversified portfolio of enduringly successful companies. Those variables do not include the national debt, the looming election, the presence or absence of Fed rate cuts, war, or the furor over the next regularly scheduled government shutdown.

- The more we focus on the fundamental strengths of our core asset, the more we’re able to tune out the noise and reduce the danger of an emotional overreaction to gyrations in “the market”.

In short, we continue to believe in our Plans, and we like everything we own. Heck, we love everything we own.

Thank you, as always, for being my DEM Spartans. It is a genuine privilege to serve as your family’s Trusted Advisor. Wishing all of you a very Happy 4th of July!

Don Davey

Senior Portfolio Manager

Disciplined Equity Management

Plan Appropriately, Invest Intelligently, Diversify Broadly, Ignore the Noise