September 30th, 2010

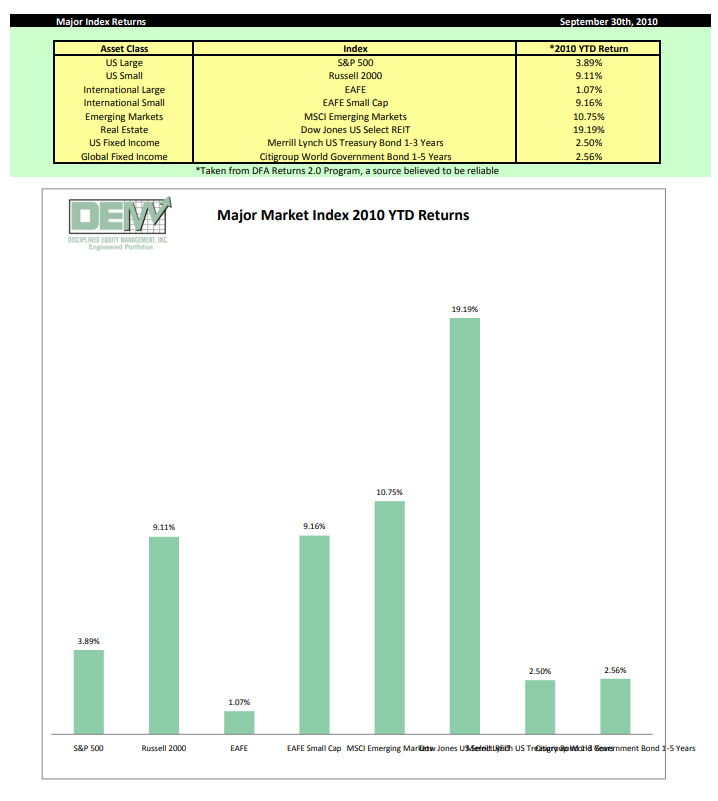

As is often the case, the global equity markets surged during a period fraught with dismal expectations. Amidst continuous noise about the sputtering economy, a double-dip recession, record high unemployment, and ongoing global financial turmoil, the equity markets unexpectedly skyrocketed during the third quarter. Punctuated by the biggest September surge since 1939, all of the major equity asset classes posted double digit gains for the quarter, bringing their year to date returns all solidly into the black.

The big news item during the quarter was the declaration from the National Bureau of Economic Research (NBER) that the Great Recession which began in December 2007 officially ended in June of 2009. We now know that the longest post-war recession in US History has been dead and gone for well over a year.

Unfortunately, investors who have been waiting for this confirmation before buying stocks have paid a very expensive price. Recall that the S&P 500 bottomed in March of 2009, a full three months prior to the end of the recession and a full year and a half before the NBER even knew the recession was over. The stock market is a remarkably efficient vehicle for discounting future events, as evidenced by its nearly 70% gain from the 2009 lows. But sadly, rather than confidently accumulating shares at discounted prices, data from the Investment Company Institute show that investors actually sold nearly $9 billion dollars worth of their equity mutual funds during the course of 2009. By panicking and selling, investors converted these perfectly normal, harmless, and temporary fluctuations into permanent losses.

We could not ask for any more convincing evidence to illustrate how investor behavior is infinitely more influential on one’s lifetime investment experience than is investment performance. Rest assured, we remain extremely confident that our low cost, passively managed, globally diversified, equity dominated portfolios will continue to perform admirably over the coming decades. However, unless we are successful in imposing our disciplined investment process through thick and thin, our performance will be meaningless.

We recently ran across an excellent book which makes this point in detail. The product of collaboration between a career Wall Street trader and an independent investment advisor, this book explains the complicated subject of intelligent investing in very simple, easy to understand language. It is a very easy and very worthwhile read for both novice and experienced investors. Thank you to both Daniel Goldie and Gordon Murray for making the text available to us in PDF format. Please enjoy:

http://www.theinvestmentanswerbook.com/The_Investment_Answer.pdf

Invest Intelligently. Diversify Broadly. Ignore the Noise.

Don Davey

Senior Portfolio Manager

Disciplined Equity Management, Inc