September 30th, 2008

Relax. Close your eyes. And breathe.

Based on the volume of phone calls and emails we have received over the past several weeks, you guys are nervous. And understandably so. The gyrations in the stock market during the third quarter of 2008 have been difficult for even the most unemotional investor to stomach. Each day seems to bring more bad news, further deterioration in the markets, and declining portfolio balances. It is time to step back and take a healthy dose of perspective regarding the concerns we have been addressing recently:

(1) I am losing money!

We all still own the same number of shares that we owned a year ago. True, these shares are temporarily worth less than they once were. But the only way the current temporary price fluctuations can turn into permanent real dollar losses is if we sell shares. The logic is simple: No panic, No sell. No sell, no loss. Therefore, we will not sell.

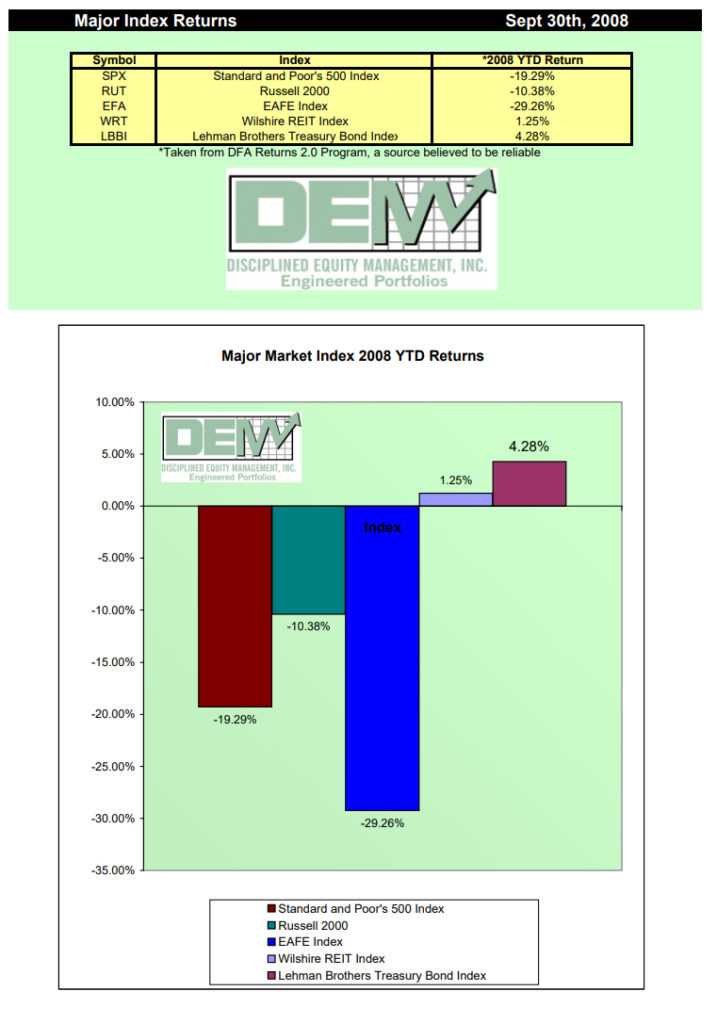

(2) My year to date returns are awful!

Unlike the 2000-2002 Bear Market, our equity portfolios have fallen about in line with the overall market this year. Even so, any client that has been with us for any appreciable length of time has achieved impressive gains since inception. Ironically, your Investment Returns will not ultimately determine how much money you accumulate over your lifetime. Instead, it will be your Investor Behavior during times like these. Abandoning a disciplined investment approach at the wrong time during a Bear Market has the potential of derailing your Lifetime Financial Plan.

(3) The S&P 500 has fallen roughly 30% over the course of the past twelve months!

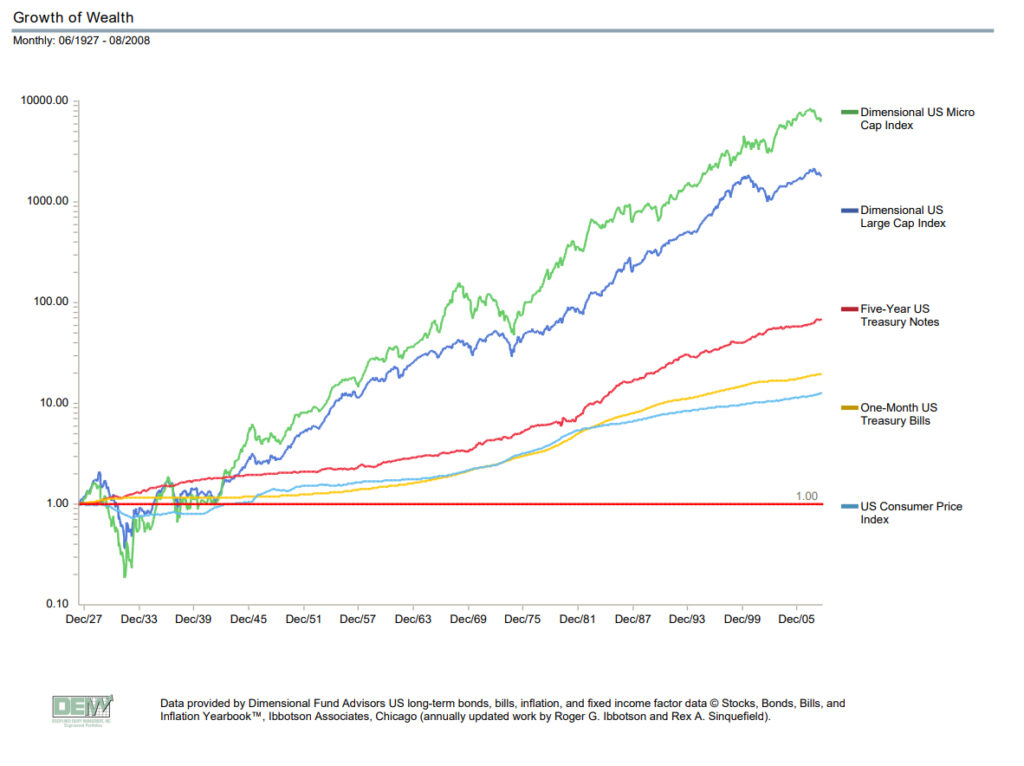

The US Stock Market has endured no fewer than twelve Bear Markets since the end of World War II. The average decline has been 30% over the course of 380 days. Despite that, one dollar invested in the S&P 500 in 1945 is now worth over $900. Yes, 900 time higher. This is not the first, nor will it be the last Bear Market we will experience. History will prove the current downturn to be just another blip on the long-term chart.

(4) But the current crisis in the credit markets is unprecedented!

From 1980-1990, several hundred banks failed in the US. During the same time period, the US economy thrived while the S&P 500 almost quintupled. The US has experienced Wars, Recessions, Hyper-Inflation, Oil Shocks, Assassinations, and many other “Crises” in the past. Each one was unprecedented. But the US economy has emerged stronger and better from every single one of them.

(5) Can’t we get out of stocks for a while until things settle down?

No. Stock market recoveries tend to occur very rapidly and in very large spurts. We have already seen multiple days where the Dow has lost 500 points in a single day. At some point the markets will begin recovering. Being out of the market during just a handful of these days could be very expensive. The only way we can guarantee 100% participation in the inevitable recovery is to remain fully invested.

(6) There is nothing on the horizon that will pull us out of this!

Oddly enough, the Great Recovery cannot begin until everyone is convinced there is no end in sight. As we outlined last quarter in our “Anatomy of a Recession”, only once pessimism rules the streets can the markets begin to recover.

(7) Declining stock prices will make it impossible for me to achieve my long-term goals!

Actually, the opposite is true. Those of us who methodically purchase shares of our globally diversified portfolios on a regular basis are actually cheering the market lower. For us, declining prices are a blessing, not a curse. Every dollar we invest at these levels buys us more and more shares. Fortunes are made by Accumulators during Bear Markets.

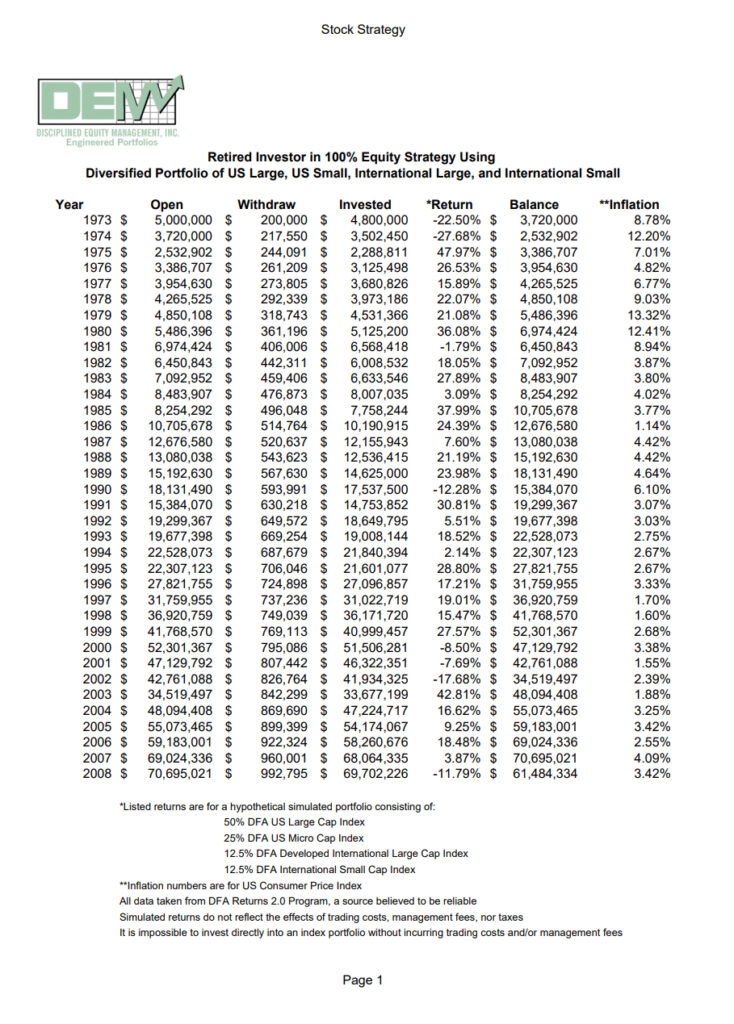

(8) My portfolio is my sole source of income. Declining stock prices will force me back to work!

Our Personal Endowment approach to financial independence means our portfolios are designed to fund our clients’ lifestyles for decades through multiple Bear Markets. We adhere to three fundamental tenets:

- We maintain a healthy exposure to stocks to provide inflation-beating returns over the course of several decades

- We limit our annual distributions to 4% – 5% of the initial portfolio value

- We maintain two years worth of cash reserves to prevent us from having to liquidate shares during Bear Markets

Consider the following example of a 60 year old who retired with an initial portfolio of $5,000,000 who began withdrawing $200,000 per year in 1973, right before the 1973-74 Bear Market. After his first two years, his portfolio was down over 50%. However, during the course of a normal 35 year retirement, his $200,000 annual withdrawal grew to almost $1,000,000 and his Personal Endowment grew to over $60,000,000.

(9) Why aren’t we changing our strategy?!

Markets like these are precisely the reason we developed our approach in the first place. It completely removes the detrimental emotional element of investing and forces us to invest wisely at all times. One look at the long term chart shows how foolish it would have been to abandon stocks during any of the prior Bear Markets.

(10) What do we do now?

As painful as this period has been, the markets may very well get worse before they get better. None of us can control the day to day movements in the stock market. As such, we urge you to stop fretting over the news. Focus on the things you can control: your job, your business, your personal cashflow, your relationships with the people you love, etc. For those of you who are able, we will increase your contributions to your account to take full advantage of this opportunity. If that is not practical for you, we will stay the course.

Please feel free to contact us at (904) 222-0280 or [email protected] with any of your questions or concerns.

Don Davey

Senior Portfolio Manager

Disciplined Equity Management, Inc