June 30th, 2008

The Anatomy of a Recession

Surging oil prices, the collapsing housing market, and the credit crisis in the financial sector have continued to weigh heavily on the US economy during the first half of 2008. As a result, the probable recession we alluded to last quarter appears to be very much upon us. Unlike during the last recession, all equity asset classes have been similarly punished this year: US Large Stocks are down 11.91%, US Small Stocks are down 9.37%, and International stocks are down 10.58%.

Of course, we will not know for sure whether we are in a recession until the National Bureau of Economic Research makes its official declaration sometime next year. As we have said many times, recessions, and the accompanying stock market declines, are a normal and healthy part of the business cycle. In fact, the US economy has experienced no fewer than ten recessions since the end of World War II. The circumstances surrounding each one tend to be different, but their effect on the stock market tends to be similar.

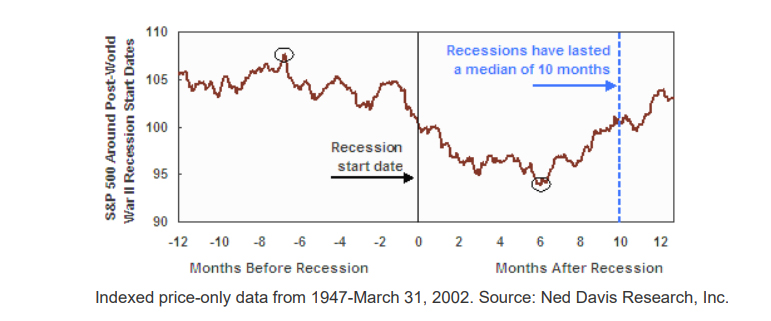

As evidence, consider the chart below from Ned Davis Research which shows the average performance of the S&P 500 Index before, during, and after the last ten recessions:

Because the stock market discounts future events, it typically peaks six to eight months prior the beginning of a recession. While the economic headlines are still rosy, the stock market inexplicably begins to decline. These declines are often dismissed as temporary because of the seemingly strong (past) fundamentals of the economy.

By the time the newspapers begin hinting that an economic slowdown may be upon us, the stock market has already declined substantially. At an average of six months into a recession, when the newspapers are full of nothing but economic doom and gloom, the market quietly bottoms and begins to ascend. By the time the recession has ended, the stock market has typically advanced substantially and the new Bull Market is already well underway.

We are not making any predictions about the duration nor magnitude of the current Bear Market. We are simply providing some perspective on the current situation. Recall how when the Dow plunged to 7,000 back in 2002, we used this newsletter to urge all of our clients to (at worse) stay the course in our disciplined approach, or (at best) add money to their portfolios to take advantage of the eventual rebound. Those who heeded our advice were well-positioned to benefit from the ensuing market recovery. Just as with every other Bear Market in US history, this too shall pass.

Invest Intelligently, Diversify Broadly, Ignore the Noise.

Don Davey

Senior Portfolio Manager

Disciplined Equity Management