December 31st, 2007

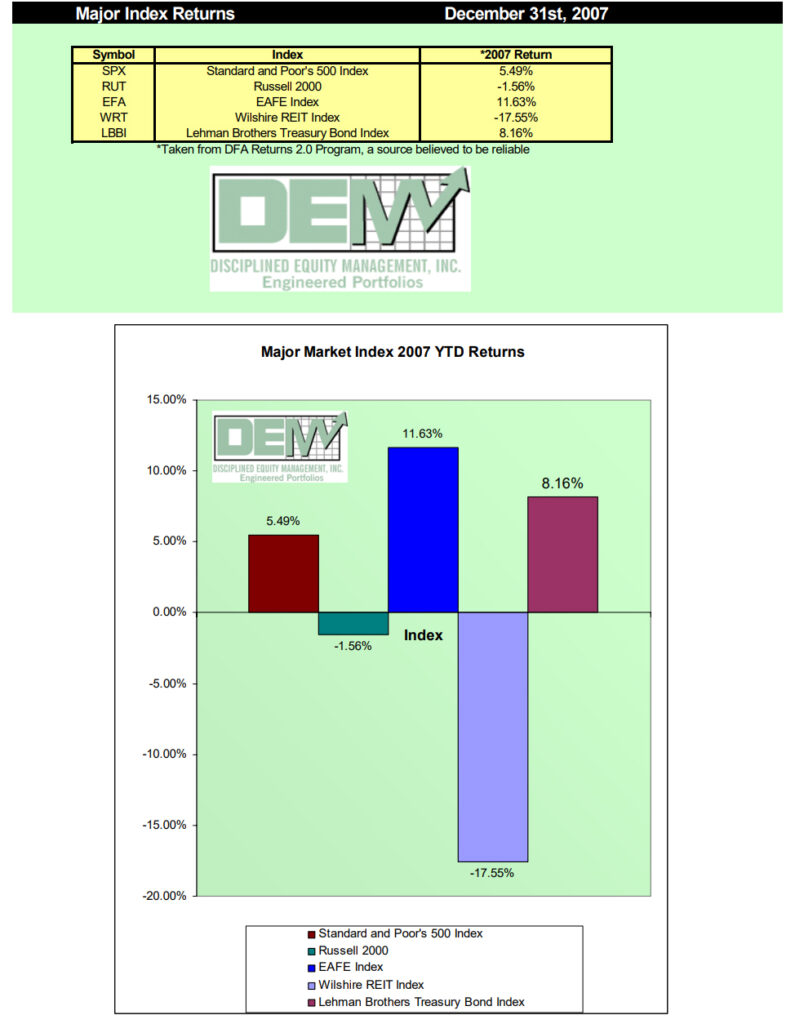

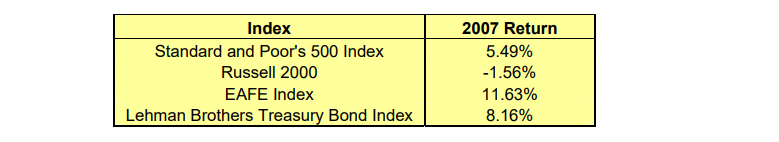

The slowing US economy, the collapse of the housing market, and the sub-prime mortgage meltdown dominated the financial headlines throughout 2007. Despite all of the negative news and volatility in the markets, the S&P 500 large cap stock index managed to produce a respectable 5.49% gain for the year. Unfortunately, this was not enough to eclipse the Treasury Bond Index return of 8.16%.

As if to add insult to injury, our globally diversified DEM equity portfolios underperformed the broad market averages for the first time this decade. The tilt in our portfolios toward small cap, value, and international stocks failed to produce the premiums we observe over longer time horizons. Therefore, 2007 goes into the books as rare victory for both (1) bonds over stocks and (2) the S&P 500 over our DEM globally diversified portfolios.

Remember that our primary goal is to diversify our large cap holdings by surrounding them with investments that perform “differently” (not necessarily “better”) over the short run than the S&P 500. We reduce our overall portfolios’ volatility by deploying capital among asset classes that tend to zig and zag on different market cycles. The 2007 numbers demonstrate this perfectly. Note how the small company stocks of the Russell 2000 performed much worse than the S&P 500. And, despite the misguided theory that global economies now all move in lockstep with one another, the international stocks in the EAFE index performed much better than the US stocks in the S&P 500. We intentionally own all three types of stocks, fully expecting them to produce different short term returns. As we move into 2008, we will be looking for opportunities to trim our over weighted international holdings and reinvest the proceeds into under weighted small caps so that we maintain our target allocations. Our disciplined approach always forces us to sell one asset class high while we buy another one low.

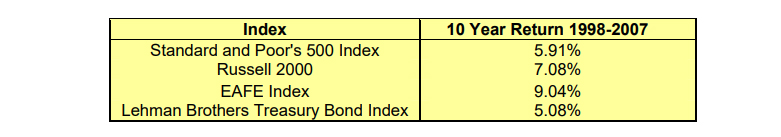

Short term returns aside, we see an entirely different picture unfold when we take a longer term perspective. Over the ten year period ended December 31st, 2007, all of the major equity asset classes performed better than bonds. In addition, the small capitalization stocks that comprise the Russell 2000 and the international stocks of the EAFE index both significantly outpaced the large cap stocks of the S&P 500. We are quite happy to lose the occasional short term performance battle on our way toward winning the long-term war.

Just as we must expect bonds to outperform stocks occasionally, we must also expect our portfolios to under perform the broader market from time to time. However, short term periods of under performance do nothing to waiver our faith in our approach. We are certain to see a whole new set of breaking news and market gyrations in 2008. As in every year, the key to having a successful long-term investment experience will be to ignore the short-term gyrations and maintain our disciplined long-term investment approach.

Don Davey

Senior Portfolio Manager

Disciplined Equity Management, Inc.