June 30th, 2006

The (Not So) Magnificent Seven

Observation: The Dow Jones Industrial Average recently traded near 10,800, almost exactly at its closing price in June of 1999. Ignoring dividends, most investors’ proxy for “the market” has experienced a painful seven year stretch of sideways performance.

Speculators often point to such periods as evidence that a long term “buy and hold” strategy is doomed to fail. Instead, they try to tempt investors into implementing any one of a number of market timing strategies. Although they differ slightly in mechanics, all of these strategies purport to “get you in the market while it is going up” and “get you out of the market while it is going sideways or down”. The idea of profiting from good markets while avoiding loss in bad markets is certainly appealing, even to us. The problem, of course, is that despite the literally millions who have tried, no investor in history has been able to produce a reliable set of indicators for either getting into or getting out of the market profitably on any sort of consistent basis.

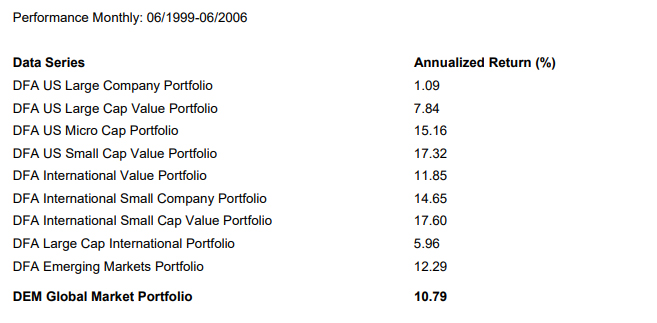

Always the optimists, we would like to use the recent sobering market performance to illustrate a key component of our investment approach. Rather than attempt to time the market with our clients’ assets, we implement a more prudent approach: diversification. We know from our historical research that it is possible to identify investment styles which tend to behave differently during the course of the same market cycles. Our research also demonstrates convincingly that every investment style will experience periods of sub-par performance from time to time. As such, we construct diversified portfolios containing multiple investment styles which tend to zig and zag at different times. Although our individual components may lead or lag for extended periods, our overall portfolios tend to provide reliable, consistent returns. As an illustration, consider the performance of our individual DFA Funds versus our typical DEM Global Market Portfolio during the past seven years:

Much like the Dow, even our own DFA US Large Company Portfolio has been essentially flat for the past seven years. In contrast, note the performance of the other investment styles. Each of our other funds has produced a substantially higher return. In fact, our US Small Company and International Funds have experienced exceptional returns. Most importantly, note that our diversified DEM Global Market Portfolio (containing each of the funds in our target allocations) produced an annualized return of 10.79% during this same stretch of flat performance by “the market”. Although we had no idea what the market was going to do seven years ago, our intelligent investment approach has served us very well.

Don Davey

Senior Portfolio Manager

Disciplined Equity Management, Inc.