March 31st, 2005

After posting impressive gains in both 2003 and 2004, the equity markets have gotten off to a slow start thus far in 2005 The S&P 500 large cap index posted a negative return of -2.6% for the first quarter. The Russell 2000 small cap index fared even worse with a –5.6% loss. The EAFE international index posted the highest relative performance with a loss of only -0.8%. Different markets, different results. Rather than fret the difference in performance amongst these indexes, we celebrate it. These variations in asset class returns illustrate the essence of our diversified approach.

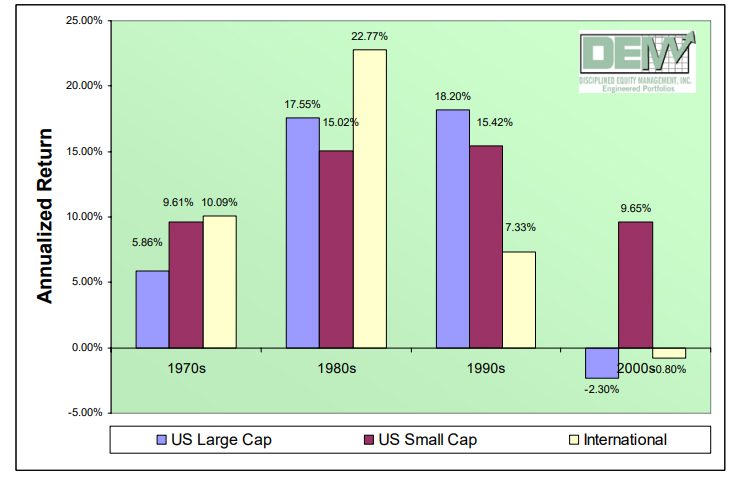

Consider the performance of the three major equity asset classes over the past 35 years when viewed by decade:

As intelligent investors, we need to be smart enough to know what we do not know. We freely admit that we cannot predict which investment style will be the top performer for the remainder of this decade, or the decade after that, or the decade after that. And despite what the talking heads on CNBC constantly try to convince you of, nobody else does either. Fortunately, we do not need to have any forecasting ability in order to be successful investors.

Rather than gambling on our predictions, our approach dictates that we own multiple equity asset classes in a pre-determined allocation and re-balance when necessary. Our resulting blended returns tend to be both (1) higher and (2) achieved more consistently than those offered from any single asset class. This disciplined approach gives us the highest probability of achieving a market-beating rate of return over our investing lifetimes.

As a result, we have no preferences for one asset class over any other. We will be happy to watch our small caps continue to run for the remainder of the 2000s. We will be equally content to see the dollar continue to fall, boosting our international investments. Or we will be delighted to watch our large caps rebound furiously to lead the market to new levels. Regardless of what the future holds, we will continue

to utilize our disciplined approach to deliver you and your family a successful investment experience.

Don Davey

Senior Portfolio Manager

Disciplined Equity Management, Inc.