December 31, 2004

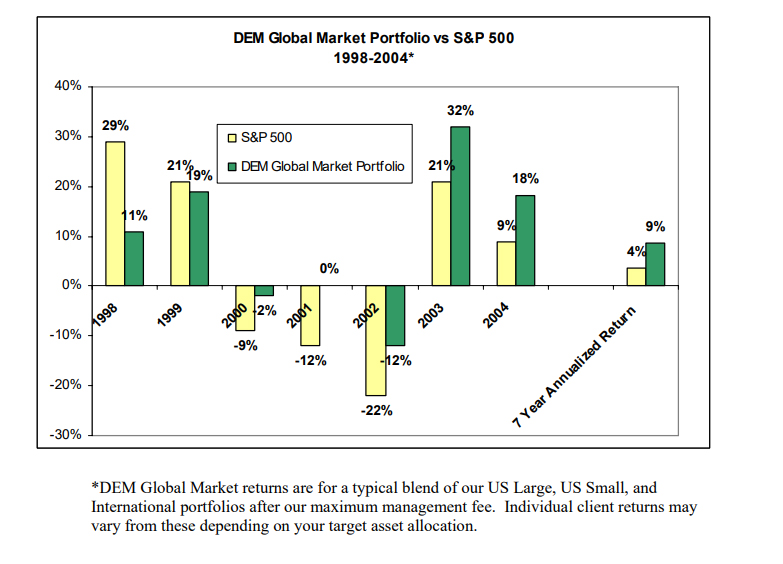

Calendar year 2004 brought us (amongst other things) continued turmoil in the Middle East, five rate hikes in the federal funds rate, a victory by the incumbent in the Presidential election, and a series of unprecedented natural disasters in the form of hurricanes and tsunami tidal waves. Through it all, our unwavering commitment to equities continues to pay big dividends for us. After a brief stall, global capitalism has been ramping back up to speed for the better part of the past two and a half years, bringing with it improved productivity, increased wages, and higher corporate profits. As the economic recovery has expanded, the stock market and our portfolios have expanded right along with it. 2004 turned out to be another excellent year for our portfolios in both relative and absolute terms. Boosted by the impressive performance of our small company and international portfolios, our equity portfolios surged an average of almost 20% in 2004 versus a gain of 9% for the S&P 500 Index.

But as you know, Disciplined Equity Management takes a much longer-term perspective on investing than other Wall Street money managers. Rather than tout our short term performance numbers, we preach over and over that week to week, month to month, and even year to year fluctuations in the equity markets (and in our portfolios) are of no consequence to us as long-term investors. Our stated objective is to achieve, and subsequently maintain, financial independence for our clients. And history makes it quite clear that the only way to do this, after fending off the dual demons of taxes and inflation, is to commit the bulk of our portfolios to stocks and simply ignore the inevitable short-term ups and downs.

The passing of another year provides us with an excellent opportunity to once again illustrate our point. We have been managing money professionally since June of 1998. During the past seven years, we have experienced the economic boom of the late 1990s, the economic bust of 2000-2002, and the ongoing economic recovery since 2003. Analyzing our portfolios through this complete economic cycle dramatically illustrates every one of our investing tenets:

(1) We are Eternal Optimists

Even through the worst bear market since the Great Depression, investors have achieved a positive real return from stocks over the past seven years. Somehow, someway, the market ALWAYS finds a way to bounce back from its temporary lows to reach another permanent high. Even when things look the bleakest, optimism is the only view that squares with long term reality.

(2) We Diversify Broadly

After underperforming the market for the better part of a decade during the 1990s, small company stocks and international stocks have been drastically outperforming US Blue Chip stocks since 2000. We know it is impossible to predict which class of stocks will be the best performer in the future. Therefore, we choose to hold multiple investment styles in our portfolios using a pre-determine asset allocation.

(3) We Utilize an Unemotional, Disciplined Approach

Our unique quantitative portfolio management techniques have added value in every single asset class. So much so that our Global Market Portfolio has outperformed the broad market by more than a 2 to 1 margin over the past seven years. By unemotionally including only those stocks with the most favorable characteristics in our portfolios, we greatly increase our probability of success.

(4) We Ignore the Noise

Wars, terrorism, political unrest, recessions, interest rate fluctuations, currency valuations, and natural disasters are all a part of the world and thus, part of investing. Although these events can be frightening to live through, they are impossible to prepare for. Fortunately, the Global Economy has been dealing with various crises for hundreds of years. Through it all, global equity markets have managed to chug along at about a 10% annual clip.

Our only prediction heading into the New Year is that 2005 is sure to bring us even more surprises. But regardless of the headlines, we will continue to own our share of the greatest wealth creation vehicle known to man: the stock market. With our guidance, achieving and maintaining financial independence for you and your family is inevitable.

On an administrative note, we are using the first quarter of 2005 to launch the electronic version of this newsletter called “The Quarterly Advisor.” The electronic version will provide us an opportunity to bring you more data, graphs, and links to additional information. Please be sure to check your email boxes.

And once again we want to thank you for the many kind referrals that you continue to send our way. There is no greater reward in our industry than receiving a phone call or an email from a friend or family member of an existing satisfied client. Because of you, Disciplined Equity Management is closing in on one hundred million dollars in assets under management. We cannot thank you enough for the confidence you have placed in us. Happy New Year!

Don Davey

Jeff Kopp