April 1st, 2003

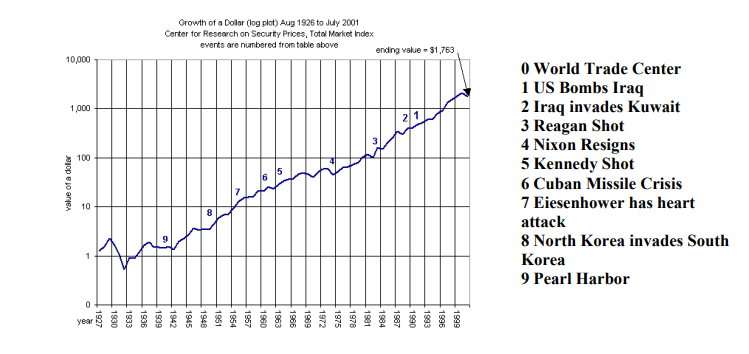

The much-anticipated war with Iraq is now underway. The most common question we have received from you this quarter has been “How will the war affect the economy and the stock market?” For some perspective, we have marked the date of some other major events this century on this long-term chart:

As Americans, we obviously worry any time our nation’s brave young men and women are sent into harm’s way to defend the freedom that we all enjoy. My oldest brother flew helicopters for the Marine Corps in Gulf War 1. The eighteen months he spent in Kuwait was a very proud, but also very scary time for my family. For those of you who have friend and/or family who are serving in Operation Iraqi Freedom, please know that our hearts and prayers go out to them as we pray for their safe return.

But as intelligent investors, we need to unemotionally step back to realize that our nation has been defending its freedom for over 200 years. Despite the inevitable dips these conflicts have caused, the US economy and the stock market have both managed to emerge stronger from every single one. In an ironic twist, past wars have actually served as the catalyst that stimulated the economy out of some of its worst recessions.

This historical perspective gives us much cause for optimism going forward. We can be quite confident that this war, this recession, and this bear market will eventually end. In fact, we intend to recycle this very same newsletter in April of 3013. With the Dow Jones Industrial Average resting comfortably above 22,000 (reflecting 11% annual growth from its current level), we will be able to look back on the current period as another blip on the long-term chart.

On another note, we are pleased to unveil a more comprehensive quarterly reporting package this quarter. In addition to this newsletter, this packet also contains a graphical portfolio holdings statement, a detailed performance report, and billing summary. Our goal is to help you better understand how the individual components of your account combine to produce a globally diversified, institutional quality portfolio that is only available to an elite group of investors.

Don Davey