“I told you so!”

– Don Davey

In March 2020, I took my family on a ski trip to Colorado for our daughters’ spring break. Just three days into the trip, we received word that the resort was closing due to a virus outbreak. Believing it was only a local issue, my wife and four daughters flew back to Jacksonville, while I stubbornly stuck to my plan of taking my daughter Carly to Los Angeles to tour the University of Southern California, a school she was considering for graduate school.

Our flight was early, so it wasn’t surprising to find only a handful of people on board. However, upon landing at LAX, it became clear that something major was happening. One of the world’s busiest terminals was eerily empty, with shops and restaurants closed. We waited over an hour for an Uber to pick us up, and the usually congested LA freeways were completely deserted as we made our way to the USC campus. When we arrived, we found the campus nearly empty as we gave ourselves a self-guided tour.

Later that evening, the news flooded in: A strange, powerful virus called COVID-19 was spreading rapidly, and the world was facing its first global pandemic in more than a century. Within days, federal, state, and local governments quarantined citizens, shuttered businesses, and halted nearly all economic activity. In response, the stock market plunged—the S&P 500 dropped 36% in just 33 days. The world was in a state of confusion and fear, and rightfully so. If there was ever a time to scream, “It’s different this time!” this was it.

Amid this global chaos, I maintained my unwavering commitment to our core principles and disciplined approach, offering the following advice in our DEM Q1 2020 Newsletter:

- Avoid selling equities by funding withdrawals from Bear Market Reserves

- Invest all available cash from interest and dividends

- Rebalance portfolios to ensure full participation in the inevitable recovery

- Ignore the Noise concerning doom-and-gloom scenarios, the economy, and the markets

As with every crisis that came before it, great companies adapted, improvised, and ultimately overcame the pandemic, while those that did not fell victim to economic Darwinism. In the five years since those dark days, the MSCI All Country World Index has compounded at over 15% annually, handsomely rewarding patient, disciplined, long-term investors.

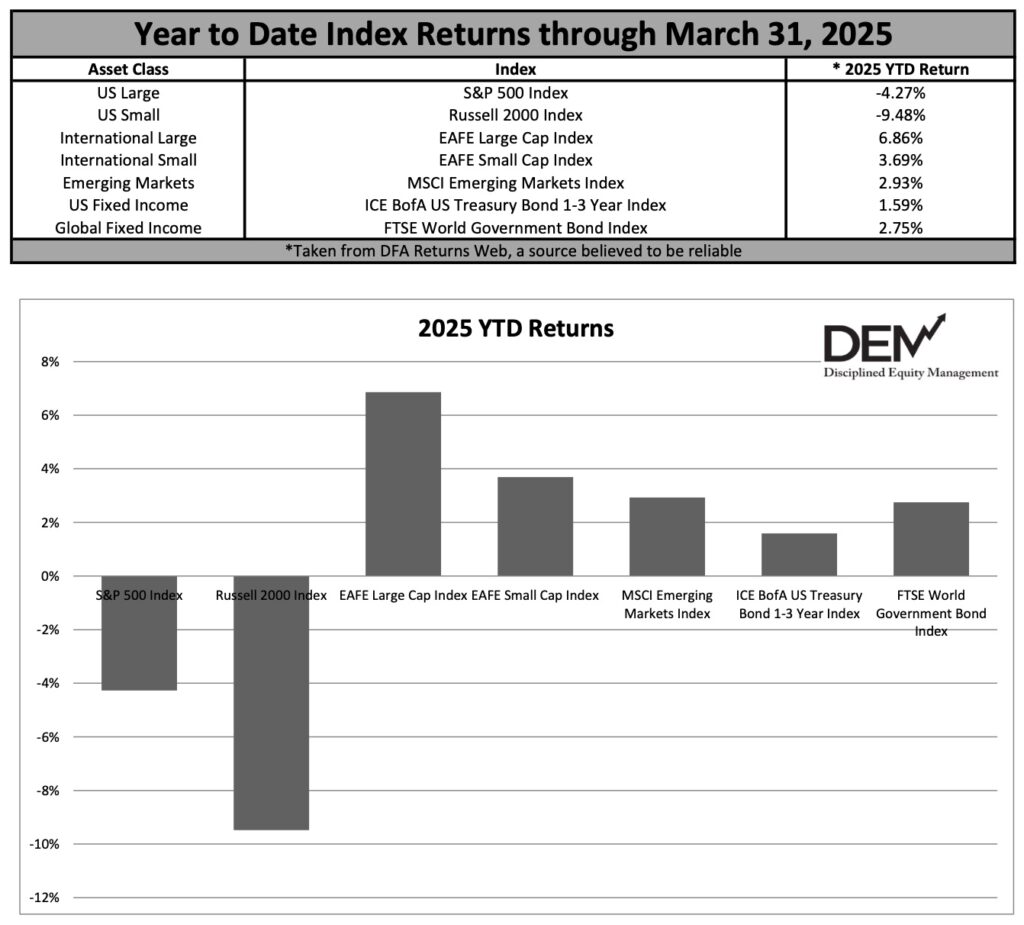

Ironically, the first quarter of 2025 has mirrored the first quarter of 2020 in many ways. Instead of a global pandemic, investors now find themselves confused and frightened over President Trump’s economic policies. In typical fashion, this fear triggered one of the fastest 10% market corrections in history—just 21 days. But amid new cries of “It’s different this time!” our advice remains unchanged: Avoid selling equities, invest all available cash, rebalance portfolios, and Ignore the Noise. We remain just as confident now as we were five years ago that we will ultimately be rewarded for adhering to our sound investment philosophy and disciplined approach.

A timely new documentary by acclaimed director Errol Morris explores how enterprising PhD students leveraged the research of their professors to revolutionize the world of investing. The documentary, fittingly titled Ignore the Noise, offers fascinating insights into the origins of what is now widely accepted as Modern Portfolio Theory, with firsthand accounts from David Booth, Rex Sinquefield, Eugene Fama, Kenneth French, and other Nobel Prize winners who were instrumental in the founding of Dimensional Fund Advisors. The documentary is available for free on YouTube during the month of April as a gift to investors everywhere.

Enjoy!

Don Davey

Senior Portfolio Manager

Disciplined Equity Management

Plan Appropriately, Invest Intelligently, Diversify Broadly, Ignore the Noise