Private Portfolio Manager

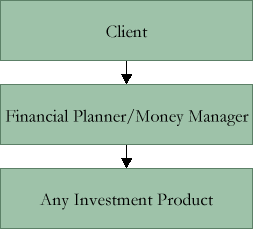

A private portfolio manager, on the other hand, recognizes that the client, not the firm, is the owner of his portfolio. As such, the client's needs must always come first. But because most affluent investors simply do not have the time, knowledge, nor discipline to successfully navigate their financial ship alone, they typically choose to rely on an independent team of financial professionals to help them achieve their goals. Under a fee-based independent investment advisor relationship, the advisor is free to utilize any investment product in the world to help his client achieve his goals--not just those offered at his particular firm.

Because he is compensated on a percentage of the assets under management, the money manager's only incentive is to achieve long-term growth of the portfolio. This aligns the best interest of the client exactly with the best interest of the advisor.

The drawback to working directly with a traditional money manager is that money managers typically specialize in only one or two investment styles. Consequently they are only equipped to invest clients' funds in those one or two portfolios. Disciplined Equity Management is unique in that we have expertise in multiple investment styles across multiple asset classes. We have the unique ability to construct institutional quality, globally diversified portfolios for our clients all within a single individually managed investment account.